No Growth in China and other Outrageous Prophecies

STOCKS, ECONOMY, CURRENCIES, POLITICS, 2009

CNBC.com | 18 Dec 2008 | 02:03 AM ET

This year has been marked by astonishing and market-changing events including a $100 fall in the price of oil, the drop to zero of U.S. interest rates and the collapse of Wall Street giants such as Lehman Brothers.

Next year could bring more, equally unbelievable, happenings such as another 400 points being wiped off the S&P 500 and a slump in Chinese growth to zero, according to a report from Saxo Bank titled “10 Outrageous Claims 2009.”

Video: David Karsbol, markets strategist from Saxo Bank, spoke to CNBC about the predictions.

1. Iranian Revolution

If oil prices continue to decline, which Saxo Bank believes they will, the Iranian society will be badly affected due to the country’s reliance on its number one commodity. The government may not be able to provide the basic necessities its citizens need, which would lead to widespread social unrest, according to Saxo Bank.

2. Crude Oil to $25

The ongoing economic crisis will further dent oil demand throughout next year, sending the price ever closer to $25 a barrel, Saxo Bank said. OPEC production cuts will be hampered by disagreement and fail to stem the slide, it added.

3. S&P 500 to 500

The S&P 500 will fall to 500 points in 2009 as slowing corporate earnings will drag on the U.S. index, according to Saxo Bank. Earnings will slow because of a continued consumer recession, lead by the credit shortage. An increase in corporate funding costs, falls in house prices and a slowdown in investing programs will also add to the weakness, the report said.

4. Italy Could Drop the Euro

Italy could make good on threats to leave the European Exchange Rate Mechanism (ERM) and may drop out in 2009, Saxo Bank said, a decision which would mean the country effectively gives up the euro. The EU is likely to crack down on excessive government budget deficits, which could prompt Italy to leave the currency regulation, it said.

5. Australian Dollar to Slump vs Yen

The Australian dollar will sink to 40 Japanese yen as next year’s continued slump in commodities hurts the Australian economy, Saxo Bank said. The whole commodity complex will be left dead in the water for the next ten years, the report said.

6. Dollar to Outstrip the Euro

The euro will fall to 0.95 cents versus the dollar in the New Year, before shifting direction and rising to 1.30 cents, according to Saxo Bank. The euro-zone will face a tough year in 2009 as the banking sector will suffer because of its exposure to Eastern Europe, a region that will increasingly falter next year, the report said.

7. Chinese GDP Growth to 0%

Export-led China will be hit by the double blow of a slowing U.S. economy and the souring of commodity-based investments, according to Saxo Bank. Japan will not actually sink into recession, despite gross-domestic-product growth all but disappearing, the report said.

8. Eastern European Forex Pegs to Fail

Several of the Eastern European currencies currently pegged or semi-pegged to the euro will come under increasing pressure to decouple next year, the report said. The emerging economies are vulnerable to more credit-market disruptions, it added.

9. Commodities Prices to Plunge

Commodities are facing widespread weakness next year with the Reuters/Jefferies CRB Index to drop 30 percent, according to Saxo Bank. The consensus belief that demand has been outstripping supply for years might not even be true and more stockpiles could be revealed, the report said.

10. Yen to Become Currency Peg

Asian countries could shun dollar pegs in favor of the Chinese yen next year, according to Saxo Bank. China’s economic, political and cultural influence is growing and shifts in market re-evaluations will favor the country, the report added.

Thursday, December 18, 2008

Thursday, November 6, 2008

Barack Obama ETF Portfolio Sector ETFs

Consumer Discretionary Consumer Discretionary Select Sector SPDR XLY

Hospital Managers and Medicaid Companies iShares Dow Jones U. S. Healthcare Providers IHF

Natural Gas United States Natural Gas UNG

Solar Power Market Vectors Solar Energy KWT

Wind Power First Trust Global Wind Energy FAN

Hospital Managers and Medicaid Companies iShares Dow Jones U. S. Healthcare Providers IHF

Natural Gas United States Natural Gas UNG

Solar Power Market Vectors Solar Energy KWT

Wind Power First Trust Global Wind Energy FAN

Wednesday, October 8, 2008

Oct 2008

I want to record the historical event here so that I can refer:

Starting from Oct, 2008, right after the 700B bailout got approved by the house for the 2nd time, the market tumbled. Within 5 days, market went on free fall. It dropped more than 16% in a roll.

The economic all sudden stopped running. The credit crisis starts with nobody (banks) wanted to lend with each other. I was adding long positions like crazy. Now I am all underwater.

Starting from Oct, 2008, right after the 700B bailout got approved by the house for the 2nd time, the market tumbled. Within 5 days, market went on free fall. It dropped more than 16% in a roll.

The economic all sudden stopped running. The credit crisis starts with nobody (banks) wanted to lend with each other. I was adding long positions like crazy. Now I am all underwater.

Friday, October 3, 2008

FEED

Friday, market went up 300 pts then nosed down to -150. All Ren's holdings are underwater.

Michelle was just panic and peeled to her pants. She wanted to sell everything, especially FEED. She thinks FEED would not be able to get back to buying level for very long time. She suggested to sell and change to something else such as MOS, FRO.

MOS -- $40.8

FRO -- $42

Michelle was just panic and peeled to her pants. She wanted to sell everything, especially FEED. She thinks FEED would not be able to get back to buying level for very long time. She suggested to sell and change to something else such as MOS, FRO.

MOS -- $40.8

FRO -- $42

Tuesday, September 30, 2008

History has been made

Yesterday, 9/29/2008, Dow down 777 pts. Today's action:

1. Buy BPT 100 shares each in Roths;

2. Average down UYG 200 shares;

3. Average down SSO 200 shares;

4. Average down 100 shares of FRO & Sell SPY puts in r2y.

1. Buy BPT 100 shares each in Roths;

2. Average down UYG 200 shares;

3. Average down SSO 200 shares;

4. Average down 100 shares of FRO & Sell SPY puts in r2y.

Tuesday, September 23, 2008

building up a profitable portfolio

1. renshan2: DBA & GDX holding with option play.

2. renshan2735: UNG, DUK, and SPY trade

3. r2y: FRO & FEED & LKQX holding, option play

4. roth: BPT

5. sep: DUK

2. renshan2735: UNG, DUK, and SPY trade

3. r2y: FRO & FEED & LKQX holding, option play

4. roth: BPT

5. sep: DUK

Monday, September 22, 2008

Friday, September 19, 2008

Monday, August 25, 2008

Visited Georgetown Village at Woodbridge

The community is in bad shape. The problem is it is 100% black. Not Good.

Thursday, May 22, 2008

How to create new user account

By invoke http://www.icctoday.com/_layouts/CreateAdAccount.aspx with pass user creditial

Wednesday, April 9, 2008

Wednesday 4-9-2008

For those days, the market was very bothering. Although there were a couple of days huge up days with huge volumes, the rest of the days were just a slow drifting. The FA side is all bad news, even Fed is admitting that the economy is going to recession. A day ago, BB said he saw the downturn would be not very serviou. Next day, the fed meeting minutes showed they were very concerned about the deep recession. From the TA side, the market is over-bought. So I have kept adding small short positions to the indices.

Thursday, April 3, 2008

GOLD related ETFs

DGL Gold long

DGP Gold Double long

DGZ Gold Short

DZZ Gold Double short

GLD Gold

GDX Gold miners

DGP Gold Double long

DGZ Gold Short

DZZ Gold Double short

GLD Gold

GDX Gold miners

Wednesday, April 2, 2008

Wednesday 4-2-2008

1:15 PM

Today Ben Bernanke testified infront of the congress, and said that the recession is coming. My question is that why till now he started telling the real thing, and what he had done during those 6 months.

Basically, he had cut interest rate more than 9 times, injected fed funds more than $300 billion, loss many montery policies for the banks. Now, he thinks that it is pretty enough to cure the economy or it is out of his hand. Obviously, the main street feels the pain. I don't know if it is the time to be bullish instead of bearish.

So actually, at this time, TA should be shining. From the TA, I believe that the market is at this short term top.

Today Ben Bernanke testified infront of the congress, and said that the recession is coming. My question is that why till now he started telling the real thing, and what he had done during those 6 months.

Basically, he had cut interest rate more than 9 times, injected fed funds more than $300 billion, loss many montery policies for the banks. Now, he thinks that it is pretty enough to cure the economy or it is out of his hand. Obviously, the main street feels the pain. I don't know if it is the time to be bullish instead of bearish.

So actually, at this time, TA should be shining. From the TA, I believe that the market is at this short term top.

Monday, March 17, 2008

Monday 3-17-2008

9:30 PM

The market was choppy. The world market plunged, and Bear Sterns was marketed at $2. But the US market pre-market went down 200 and at close, the Dow was up 20 pts, Naz down 35, and SP down 11 pts. The PPT at work is very clear. Intraday, DJ Wilshire 5000, Naz and SP made new low.

To me, the bottom is no there yet. Tomorrow, there will be Fed decision. Add short positions on any bounce.

The market was choppy. The world market plunged, and Bear Sterns was marketed at $2. But the US market pre-market went down 200 and at close, the Dow was up 20 pts, Naz down 35, and SP down 11 pts. The PPT at work is very clear. Intraday, DJ Wilshire 5000, Naz and SP made new low.

To me, the bottom is no there yet. Tomorrow, there will be Fed decision. Add short positions on any bounce.

Saturday, March 15, 2008

Commodity ETFs and ETNs

Which of the 6 Agriculture ETFs is Best?

http://seekingalpha.com/article/64802-which-of-the-6-agriculture-etfs-is-best

Commodity ETFs (exchange-traded funds) and ETNs (exchange-traded notes) List

(click on symbol for data and articles)

Broad Based Commodity ETFs and ETNs

GreenHaven Continuous Commodity Index (GCC)

GS Connect S&P GSCI Enhanced Commodity Total Return Strategy Index ETN (GSC)

iShares GSCI Commodity-Indexed Trust ETF (GSG)

iPath Dow Jones-AIG Commodity Index Total Return ETN (DJP)

iPath S&P GSCI Total Return Index ETN (GSP)

PowerShares DB Commodity Index Tracking Fund ETF (DBC)

Agricultural Commodities ETFs

ELEMENTS Linked to the MLCX Biofuels Index ETF (FUE)

ELEMENTS Linked to the MLCX Grains Index ETF (GRU)

ELEMENTS Linked to the Rogers International Commodity Index – Agriculture ETN (RJA)

iPath Dow Jones AIG-Agriculture ETN (JJA)

iPath Dow Jones AIG-Grains ETN (JJG)

iPath Dow Jones-AIG Livestock Total Return Sub-Index ETN (COW)

PowerShares DB Agriculture Fund ETF (DBA)

Gold, Silver and Metals ETFs

iPath DJ-AIG Industrial Metals Total Return Sub-Index (JJM)

iPath DJ-AIG Nickel Total Return Sub-Index (JJN)

iShares COMEX Gold Trust ETF (IAU)

iShares Silver Trust ETF (SLV)

PowerShares DB Gold Fund ETF (DGL)

streetTRACKS Gold Shares ETF (GLD)

PowerShares DB Silver Fund ETF (DBS)

PowerShares DB Precious Metals Fund ETF (DBP)

PowerShares DB Base Metals Fund ETF (DBB)

Oil and Gas ETFs and ETNs

Claymore MACROshares Oil Up Tradeable ETF (UCR)

iPath DJ-AIG Energy Total Return Sub-Index (JJE)

iPath DJ-AIG Natural Gas Total Return Sub-Index (GAZ)

iPath S&P GSCI Crude Oil Total Return Index ETN (OIL)

PowerShares DB Energy Fund ETF (DBE)

PowerShares DB Oil Fund ETF (DBO)

United States Gasoline Fund, LP ETF (UGA)

United States Oil Fund, LP ETF (USO)

United States 12 Month Oil Fund, LP ETF (USL)

United States Natural Gas Fund, LP ETF (UNG)

Commodities-Related ETFs

Van Eck Market Vectors Agribusiness ETF (MOO)

Van Eck Market Vectors Coal ETF (KOL)

Van Eck Market Vectors Gold Miners ETF (GDX)

What Are They?

Commodity ETFs (exchange traded funds) attempt to track the price of a single commodity, such as gold or oil, or a basket of commodities by holding the actual commodity in storage, or by purchasing futures contracts. Because futures provide leverage (more exposure than the actual cash invested), ETFs that use futures contracts have uninvested cash, which they usually park in interest-bearing government bonds. The interest on the bonds is used to cover the expenses of the ETF and to pay dividends to the holders.

Commodity ETNs (exchange traded notes) are non-interest paying debt instruments whose price fluctuates (by contractual commitment) with an underlying commodities index. Because they are debt obligations, ETNs are subject to the solvency of the issuer.

Commodities-related ETFs generally track the producers of commodities, such as mining companies. While the financial performance of those companies -- and thus their stocks -- may be highly leveraged to the underlying commodity, other factors can impact the profitability of production. The ETFs, therefore, may not reflect the performance of the underlying commodity. For example, gold miners are highly leveraged to the discovery of gold deposits, exchange rates and their relationships with the countries where gold deposits are found.

Why & How To Use Them

Commodities are a separate asset class from stocks and bonds, so they provide extra diversification in a portfolio.

The case for commodities: The industrialization of the China and India and the integration of Russia and Eastern Europe into the global economy are boosting demand for commodities, driving up prices. Many people believe that this will result in a long term uptrend ("super cycle") in commodity prices.

The case against commodities: In contrast to stocks and bonds, commodities are not income generating. So ownership of commodities, including via ETFs or ETNs, is a pure bet on prices. And the expenses charged by the ETF and ETN providers and in the cost of storing hard assets or trading futures eat away at the underlying value of the fund.

Commodity ETFs and ETNs can also be used as a hedge. For example, if you consume a large amount of gasoline and heating fuel and are concerned about the impact on your income of a rise in oil and gas prices, buying an oil and gas ETF can help offset your exposure.

What to Look Out For

Commodities ETFs that use futures have diverged significantly from the price of the hard commodities themselves. ETNs, in contrast, track the price of the commodity closely. See the articles in the Further Reading section below.

There are dramatic differences in structure of these ETFs and ETNs, even for the same commodities, leading to potential differences in performance and tax treatment.

ETFs and ETNs are treated differently for taxation purposes. Current opinion is that all gains on ETNs held for longer than one year are treated as long-term capital gains, whereas an investor owning a futures-based ETF is taxed on any capital gains on the underlying futures held by the fund using the taxation convention for futures, ie. at a hybrid rate of 60% long-term, 40% short-term each year on all gains, even if the investor doesn't sell the fund. (Check this carefully with your accountant.)

Further Reading

For long term investors considering including a commodity ETF in a diversified portfolio, the value of commodities as a diversifier is addressed by Nik Bienkowski in Commodities Outperform During Equity Market Downturns. Mebane Faber discusses a portfolio including commodities exposure in An Endowment Portfolio From Publicly-Traded Vehicles. For a negative view on the investment case for commodities, see Bill Miller on Oil, Silver, Other Commodities: Don't Buy!.

Roger Ehrenberg discusses using commodity ETFs to hedge real exposure to oil and gas in Think Carefully Before Macro Hedging Your Life/Work/Oil Exposures.

The underperformance of futures-based commodity ETFs relative to the actual commodity they are supposed to track is discussed in Scott Rothbort's US Oil Fund ETF Fails Investors Consistently. Richard Shaw presents the case for commodity ETNs over commodity ETFs in Troubled By ETF Tracking Failures? Try ETNs. See also The ETN Market Heats Up With Goldman Launch; More On the Way (Matt Hougan).

Should you use a broad commodities ETF or a set of ETFs or ETNs that track individual commodities? See Richard Kang's Is Commodity ETF Slicing and Dicing Necessary?.

For further analysis of these ETFs, and comparisons between them, see: Commodity ETF Overview (Tim Iacono), A Look at the New GreenHaven Commodity ETF (Hard Assets Investor), Commodity Exposure Via ETFs: A Fund Manager's Process (Keith Lenger), Ameristock Funds' New Gas Futures ETF: An Attractive Instrument In So Volatile a Market (Matt Hougan), First Gasoline ETF Comes to Market (Murray Coleman), Natural Gas ETF Is No Long Term Hold (Zman), New iShares GSCI Commodity Trust - Key Points To Understand (Market Participant), Commodities ETFs Protect The Little Guy (Tim Iacono), The New Generation of Diversified Commodity Indexes (Rich White), New ETF Tracks Oil-Prices Across 12 Months (Eli Hoffmann) and Digging Deeper Into Commodity-Based Funds (Keith Lenger).

For analysis and discussion of agricultural commoditiies ETFs see Powershares' Agricultural ETF: The Soft Commodities Slam Dunk (Nicolas Vardy), PowerShares DB Agriculture ETF: 'Optimum Yield' or Undue Risk? (Don Dion) and Which of the 6 Agriculture ETFs is Best? (Matthew D. McCall).

http://seekingalpha.com/article/64802-which-of-the-6-agriculture-etfs-is-best

Commodity ETFs (exchange-traded funds) and ETNs (exchange-traded notes) List

(click on symbol for data and articles)

Broad Based Commodity ETFs and ETNs

GreenHaven Continuous Commodity Index (GCC)

GS Connect S&P GSCI Enhanced Commodity Total Return Strategy Index ETN (GSC)

iShares GSCI Commodity-Indexed Trust ETF (GSG)

iPath Dow Jones-AIG Commodity Index Total Return ETN (DJP)

iPath S&P GSCI Total Return Index ETN (GSP)

PowerShares DB Commodity Index Tracking Fund ETF (DBC)

Agricultural Commodities ETFs

ELEMENTS Linked to the MLCX Biofuels Index ETF (FUE)

ELEMENTS Linked to the MLCX Grains Index ETF (GRU)

ELEMENTS Linked to the Rogers International Commodity Index – Agriculture ETN (RJA)

iPath Dow Jones AIG-Agriculture ETN (JJA)

iPath Dow Jones AIG-Grains ETN (JJG)

iPath Dow Jones-AIG Livestock Total Return Sub-Index ETN (COW)

PowerShares DB Agriculture Fund ETF (DBA)

Gold, Silver and Metals ETFs

iPath DJ-AIG Industrial Metals Total Return Sub-Index (JJM)

iPath DJ-AIG Nickel Total Return Sub-Index (JJN)

iShares COMEX Gold Trust ETF (IAU)

iShares Silver Trust ETF (SLV)

PowerShares DB Gold Fund ETF (DGL)

streetTRACKS Gold Shares ETF (GLD)

PowerShares DB Silver Fund ETF (DBS)

PowerShares DB Precious Metals Fund ETF (DBP)

PowerShares DB Base Metals Fund ETF (DBB)

Oil and Gas ETFs and ETNs

Claymore MACROshares Oil Up Tradeable ETF (UCR)

iPath DJ-AIG Energy Total Return Sub-Index (JJE)

iPath DJ-AIG Natural Gas Total Return Sub-Index (GAZ)

iPath S&P GSCI Crude Oil Total Return Index ETN (OIL)

PowerShares DB Energy Fund ETF (DBE)

PowerShares DB Oil Fund ETF (DBO)

United States Gasoline Fund, LP ETF (UGA)

United States Oil Fund, LP ETF (USO)

United States 12 Month Oil Fund, LP ETF (USL)

United States Natural Gas Fund, LP ETF (UNG)

Commodities-Related ETFs

Van Eck Market Vectors Agribusiness ETF (MOO)

Van Eck Market Vectors Coal ETF (KOL)

Van Eck Market Vectors Gold Miners ETF (GDX)

What Are They?

Commodity ETFs (exchange traded funds) attempt to track the price of a single commodity, such as gold or oil, or a basket of commodities by holding the actual commodity in storage, or by purchasing futures contracts. Because futures provide leverage (more exposure than the actual cash invested), ETFs that use futures contracts have uninvested cash, which they usually park in interest-bearing government bonds. The interest on the bonds is used to cover the expenses of the ETF and to pay dividends to the holders.

Commodity ETNs (exchange traded notes) are non-interest paying debt instruments whose price fluctuates (by contractual commitment) with an underlying commodities index. Because they are debt obligations, ETNs are subject to the solvency of the issuer.

Commodities-related ETFs generally track the producers of commodities, such as mining companies. While the financial performance of those companies -- and thus their stocks -- may be highly leveraged to the underlying commodity, other factors can impact the profitability of production. The ETFs, therefore, may not reflect the performance of the underlying commodity. For example, gold miners are highly leveraged to the discovery of gold deposits, exchange rates and their relationships with the countries where gold deposits are found.

Why & How To Use Them

Commodities are a separate asset class from stocks and bonds, so they provide extra diversification in a portfolio.

The case for commodities: The industrialization of the China and India and the integration of Russia and Eastern Europe into the global economy are boosting demand for commodities, driving up prices. Many people believe that this will result in a long term uptrend ("super cycle") in commodity prices.

The case against commodities: In contrast to stocks and bonds, commodities are not income generating. So ownership of commodities, including via ETFs or ETNs, is a pure bet on prices. And the expenses charged by the ETF and ETN providers and in the cost of storing hard assets or trading futures eat away at the underlying value of the fund.

Commodity ETFs and ETNs can also be used as a hedge. For example, if you consume a large amount of gasoline and heating fuel and are concerned about the impact on your income of a rise in oil and gas prices, buying an oil and gas ETF can help offset your exposure.

What to Look Out For

Commodities ETFs that use futures have diverged significantly from the price of the hard commodities themselves. ETNs, in contrast, track the price of the commodity closely. See the articles in the Further Reading section below.

There are dramatic differences in structure of these ETFs and ETNs, even for the same commodities, leading to potential differences in performance and tax treatment.

ETFs and ETNs are treated differently for taxation purposes. Current opinion is that all gains on ETNs held for longer than one year are treated as long-term capital gains, whereas an investor owning a futures-based ETF is taxed on any capital gains on the underlying futures held by the fund using the taxation convention for futures, ie. at a hybrid rate of 60% long-term, 40% short-term each year on all gains, even if the investor doesn't sell the fund. (Check this carefully with your accountant.)

Further Reading

For long term investors considering including a commodity ETF in a diversified portfolio, the value of commodities as a diversifier is addressed by Nik Bienkowski in Commodities Outperform During Equity Market Downturns. Mebane Faber discusses a portfolio including commodities exposure in An Endowment Portfolio From Publicly-Traded Vehicles. For a negative view on the investment case for commodities, see Bill Miller on Oil, Silver, Other Commodities: Don't Buy!.

Roger Ehrenberg discusses using commodity ETFs to hedge real exposure to oil and gas in Think Carefully Before Macro Hedging Your Life/Work/Oil Exposures.

The underperformance of futures-based commodity ETFs relative to the actual commodity they are supposed to track is discussed in Scott Rothbort's US Oil Fund ETF Fails Investors Consistently. Richard Shaw presents the case for commodity ETNs over commodity ETFs in Troubled By ETF Tracking Failures? Try ETNs. See also The ETN Market Heats Up With Goldman Launch; More On the Way (Matt Hougan).

Should you use a broad commodities ETF or a set of ETFs or ETNs that track individual commodities? See Richard Kang's Is Commodity ETF Slicing and Dicing Necessary?.

For further analysis of these ETFs, and comparisons between them, see: Commodity ETF Overview (Tim Iacono), A Look at the New GreenHaven Commodity ETF (Hard Assets Investor), Commodity Exposure Via ETFs: A Fund Manager's Process (Keith Lenger), Ameristock Funds' New Gas Futures ETF: An Attractive Instrument In So Volatile a Market (Matt Hougan), First Gasoline ETF Comes to Market (Murray Coleman), Natural Gas ETF Is No Long Term Hold (Zman), New iShares GSCI Commodity Trust - Key Points To Understand (Market Participant), Commodities ETFs Protect The Little Guy (Tim Iacono), The New Generation of Diversified Commodity Indexes (Rich White), New ETF Tracks Oil-Prices Across 12 Months (Eli Hoffmann) and Digging Deeper Into Commodity-Based Funds (Keith Lenger).

For analysis and discussion of agricultural commoditiies ETFs see Powershares' Agricultural ETF: The Soft Commodities Slam Dunk (Nicolas Vardy), PowerShares DB Agriculture ETF: 'Optimum Yield' or Undue Risk? (Don Dion) and Which of the 6 Agriculture ETFs is Best? (Matthew D. McCall).

Friday, March 14, 2008

Friday 3-14-2008

12:00 AM

Some observation is very important. Yesterday, it opened lower, and went up positive. The S&P said that bank's write-down was almost done. This morning, the market went up huge with good CPI numbers. But right after the open, BSC released news that it had liquidity problem and couldn't continue with its business. It was huge bomb, and stock went down close to 300 pts.

The observation here is that yesterday, the market up with no news (some fake news issued by credited company) before the real fact news out. So we need to see the facts instead of any news.

Some observation is very important. Yesterday, it opened lower, and went up positive. The S&P said that bank's write-down was almost done. This morning, the market went up huge with good CPI numbers. But right after the open, BSC released news that it had liquidity problem and couldn't continue with its business. It was huge bomb, and stock went down close to 300 pts.

The observation here is that yesterday, the market up with no news (some fake news issued by credited company) before the real fact news out. So we need to see the facts instead of any news.

Tuesday, March 11, 2008

Tuesday 3-11-2008

12:20 PM

The market went down again yesterday. SP almost touched the Jan low. NAZ has been lower than Jan low. Dow is getting close. So it is in the virgin of breaking all time lows.

This morning, Fed injected $200B into the financial system. It offered 28 days loans to the banks. The market took it as good news, and went up 250 pts at one time. Here is some of my thoughts:

1. It happened on 2000 recession. The market went up huge before the next leg down.

2. The injection of this huge amount of money is in order to make the banks still functional in events such as stock market crash, or other financial crisis.

So, I believe there will be further very bad news coming in financial mainly. The key to the event is to monitor the market reaction, and measure the depth of this reaction. Sell to any strengths shouldn't be any issue here. Mainly short the finances sector, and indices.

The market went down again yesterday. SP almost touched the Jan low. NAZ has been lower than Jan low. Dow is getting close. So it is in the virgin of breaking all time lows.

This morning, Fed injected $200B into the financial system. It offered 28 days loans to the banks. The market took it as good news, and went up 250 pts at one time. Here is some of my thoughts:

1. It happened on 2000 recession. The market went up huge before the next leg down.

2. The injection of this huge amount of money is in order to make the banks still functional in events such as stock market crash, or other financial crisis.

So, I believe there will be further very bad news coming in financial mainly. The key to the event is to monitor the market reaction, and measure the depth of this reaction. Sell to any strengths shouldn't be any issue here. Mainly short the finances sector, and indices.

Monday, March 10, 2008

Monday 3-10-2008

2:25 PM

The market is on the down trend. The NAZ made new low. Now the S&P has touched 1270. I have just closed all the shorts positions at 2:28 pm.

The market is on the down trend. The NAZ made new low. Now the S&P has touched 1270. I have just closed all the shorts positions at 2:28 pm.

Sunday, March 9, 2008

How to Make Money in a Recession

How to Make Money in a Recession... (If You Are a Big Banker).

So you've just taken over as CEO of SuperMegaMonster Bank. Your predecessor skated off into retirement with a $200 million golden parachute, leaving you to manage $200 billion in bad loans and assorted toxic waste just as the economy is plunging into recession. What are you going to do?

Step 1: Write-Offs

Take huge one-time hits to your earnings and balance sheet and blame it all on the last guy. You'll be able to show a profit sooner if you don't have all these losses trickling in over time. When you do start claiming positive earnings again you'll get all the credit and big bonuses too.

Step 2: Offload Risk

Shift ownership of as much of your toxic waste as possible to the government and retail investors. Scare the crap out of government leaders and the Fed by telling them our entire economic system will come unraveled if they don't save the big banks. They'll enact a wide range of idiotic policies designed to bail you out of the mess your firm created and profited from in the first place. Public pension plans can be suckered into any investment so load them up with the worst of the worst.

Step 3: Credit Crunch

Call in loans to hedge funds, mortgage REITs and other investment schemes. They've served their boom cycle purpose and now they are expendable. Use the money that comes flowing back in to your coffers to purchase the securities that they are forced to unload at a steep discount. The Fed will loan you extra money at ultra cheap rates with your existing securities as collateral so that you can leverage up on even more cheap investments. Don't buy the hopeless stuff, just buy the higher quality stuff that will survive the recession or senior debt that will survive the bankruptcy process.

Step 4: Ride the Carry Trade

With short term rates low and yields high you can play the carry trade for maximum profit. Panicked investors will put their money in low yielding savings accounts and money market accounts and you can invest this in the long-term, high yielding stuff you soaked up in the credit crunch. As short term rates continue to fall, the spread widens and your profit margin increases.

Step 5: Kill Off Struggling Entities

Identify any exposure you have to companies or municipalities that are likely to become insolvent in a recession. Make sure you sell off any equities or long term debt you hold first. Then pull their short term funding to force them into bankruptcy. Layoffs and general panic will help you pick up more securities on the cheap.

Step 6: Eliminate the Competition

Take advantage of the struggling economy to wipe out any competition that grew too quickly in the last boom cycle. Sub-prime lenders? Savings and Loans? Small, local banks? REITs? Fannie Mae? Kill all you can while you can, as you don't want them to compete with you for banking business in the next boom cycle or investing opportunities late in the bust cycle.

Step 7: Debase the Currency

Lobby the Fed for low rates and the Federal Government for deficit spending. Remember that you are now a carry trader, rather than an creditor. It doesn't hurt you if debtors pay you back in a debased currency because you get to pay back depositors in a debased currency as well. To the extent that you have equities, real estate and other hard assets on your books offset by short term debt, inflation actually works in your favor. Paper gains on these assets will help your case with the compensation committee around bonus time.

Reality

No doubt, the big banks are in a very precarious situation right now, but they have their tentacles wrapped around Washington and the Federal Reserve System. There is a clear path to banking profitability and it will come almost entirely at our expense as citizens, investors and taxpayers. All of these steps overlap in the timing of their effectiveness, and I expect we'll see most of the same themes continuing to pop up over the next couple of years as the recession deepens. So far we've seen:

1. A huge "stimulus" package that will help some distressed borrowers make some more mortgage payments. (Step 2)

2. A big increase in FHA, FHLB, Fannie Mae and Freddie Mac backed loans and securities to take up some of the load off of Wall Street with regards to the mortgage mess. (Step 2)

3. The invention of "Term Auction Credit" as a way of helping big banks sustain or increase their investment portfolios. (Step 3)

4. Falling short term rates to lower the borrowing costs for big banks. (Step 4)

5. Widening spreads to increase the profitability of banks that purchase new assets. (Step 4)

6. A large credit crunch that is forcing hedge funds and other investment vehicles to sell into a difficult market, with investors taking the losses. (Step 3)

7. Continuing rapid growth of the money supply. (Step 7)

8. Struggling municipalities. (Step 5)

9. Rising inflation. (Step 7)

10. A declining dollar. (Step 7)

11. A variety of measures designed to help forestall foreclosures and let banks fudge their accounting for bad loans. (Step 2)

12. The VISA IPO. (Step 2)

13. Big banks helping Thornburg Mortgage raise $230 million in stock offerings in January, only to give them big margin calls in March. (Step 5)

14. The collapse of hundreds of smaller banks and lenders. (Step 6)

15. The abandonment of the Auction Rate Securities market. (Step 3)

16. Seizing control of hedge funds to liquidate their assets. (Step 3)

Eventually the economy will hit bottom and the banks can go back to their even more profitable boom cycle business plan, where they make money by extending credit to anyone who wants to take risks and can make the payments in an expanding economy. It might take awhile for the dust to settle this time though, because the big banks sure managed to mess the economy up badly this time.

So you've just taken over as CEO of SuperMegaMonster Bank. Your predecessor skated off into retirement with a $200 million golden parachute, leaving you to manage $200 billion in bad loans and assorted toxic waste just as the economy is plunging into recession. What are you going to do?

Step 1: Write-Offs

Take huge one-time hits to your earnings and balance sheet and blame it all on the last guy. You'll be able to show a profit sooner if you don't have all these losses trickling in over time. When you do start claiming positive earnings again you'll get all the credit and big bonuses too.

Step 2: Offload Risk

Shift ownership of as much of your toxic waste as possible to the government and retail investors. Scare the crap out of government leaders and the Fed by telling them our entire economic system will come unraveled if they don't save the big banks. They'll enact a wide range of idiotic policies designed to bail you out of the mess your firm created and profited from in the first place. Public pension plans can be suckered into any investment so load them up with the worst of the worst.

Step 3: Credit Crunch

Call in loans to hedge funds, mortgage REITs and other investment schemes. They've served their boom cycle purpose and now they are expendable. Use the money that comes flowing back in to your coffers to purchase the securities that they are forced to unload at a steep discount. The Fed will loan you extra money at ultra cheap rates with your existing securities as collateral so that you can leverage up on even more cheap investments. Don't buy the hopeless stuff, just buy the higher quality stuff that will survive the recession or senior debt that will survive the bankruptcy process.

Step 4: Ride the Carry Trade

With short term rates low and yields high you can play the carry trade for maximum profit. Panicked investors will put their money in low yielding savings accounts and money market accounts and you can invest this in the long-term, high yielding stuff you soaked up in the credit crunch. As short term rates continue to fall, the spread widens and your profit margin increases.

Step 5: Kill Off Struggling Entities

Identify any exposure you have to companies or municipalities that are likely to become insolvent in a recession. Make sure you sell off any equities or long term debt you hold first. Then pull their short term funding to force them into bankruptcy. Layoffs and general panic will help you pick up more securities on the cheap.

Step 6: Eliminate the Competition

Take advantage of the struggling economy to wipe out any competition that grew too quickly in the last boom cycle. Sub-prime lenders? Savings and Loans? Small, local banks? REITs? Fannie Mae? Kill all you can while you can, as you don't want them to compete with you for banking business in the next boom cycle or investing opportunities late in the bust cycle.

Step 7: Debase the Currency

Lobby the Fed for low rates and the Federal Government for deficit spending. Remember that you are now a carry trader, rather than an creditor. It doesn't hurt you if debtors pay you back in a debased currency because you get to pay back depositors in a debased currency as well. To the extent that you have equities, real estate and other hard assets on your books offset by short term debt, inflation actually works in your favor. Paper gains on these assets will help your case with the compensation committee around bonus time.

Reality

No doubt, the big banks are in a very precarious situation right now, but they have their tentacles wrapped around Washington and the Federal Reserve System. There is a clear path to banking profitability and it will come almost entirely at our expense as citizens, investors and taxpayers. All of these steps overlap in the timing of their effectiveness, and I expect we'll see most of the same themes continuing to pop up over the next couple of years as the recession deepens. So far we've seen:

1. A huge "stimulus" package that will help some distressed borrowers make some more mortgage payments. (Step 2)

2. A big increase in FHA, FHLB, Fannie Mae and Freddie Mac backed loans and securities to take up some of the load off of Wall Street with regards to the mortgage mess. (Step 2)

3. The invention of "Term Auction Credit" as a way of helping big banks sustain or increase their investment portfolios. (Step 3)

4. Falling short term rates to lower the borrowing costs for big banks. (Step 4)

5. Widening spreads to increase the profitability of banks that purchase new assets. (Step 4)

6. A large credit crunch that is forcing hedge funds and other investment vehicles to sell into a difficult market, with investors taking the losses. (Step 3)

7. Continuing rapid growth of the money supply. (Step 7)

8. Struggling municipalities. (Step 5)

9. Rising inflation. (Step 7)

10. A declining dollar. (Step 7)

11. A variety of measures designed to help forestall foreclosures and let banks fudge their accounting for bad loans. (Step 2)

12. The VISA IPO. (Step 2)

13. Big banks helping Thornburg Mortgage raise $230 million in stock offerings in January, only to give them big margin calls in March. (Step 5)

14. The collapse of hundreds of smaller banks and lenders. (Step 6)

15. The abandonment of the Auction Rate Securities market. (Step 3)

16. Seizing control of hedge funds to liquidate their assets. (Step 3)

Eventually the economy will hit bottom and the banks can go back to their even more profitable boom cycle business plan, where they make money by extending credit to anyone who wants to take risks and can make the payments in an expanding economy. It might take awhile for the dust to settle this time though, because the big banks sure managed to mess the economy up badly this time.

About Options Pricing /Trading

(1) 如果想对 "Black-Scholes" options pricing model有更多了解, 不妨一试下面的LINK:

http://en.wikipedia.org/wiki/Black-Scholes

You can also find many numerical methods to price options in the finance literature.

(2) If you've no time for Black and Scholes and need a quick estimate for an at-the-money call or put option, here is a simple formula.

Price = (0.4 * Volatility * Square Root(Time Ratio)) * Base Price

Time ratio is the time in years that option has until expiration. So, for a 6 month option take the square root of 0.50 (half a year).

For example: calculate the price of an ATM option @ $45 (call and put) that has 3 months until expiration. The underlying volatility is 23%.

Answer: = 0.4 * 0.23 * SQRT(.25) *$45

Option Theoretical (approx) = $2.07

(3) What Affects Equity Option Prices?

The current price of the underlying financial instrument

The strike price of the option in comparison to the current market price (intrinsic value)

The type of option (put or call)

The amount of time remaining until expiration (time value)

The current risk-free interest rate

The volatility of the underlying financial instrument

The dividend rate, if any, of the underlying financial instrument

注意不要本末倒置, 抓住重点, 才能有的放矢。

(4) 对于个人帐户, trading gamma vega theta rho....常常会十分困难, 甚至可以忽略不计, 但俺赞成在trading options前, 对这些概念最好有深入的了解。 Options are the most versatile trading instrument ever invented。 它的最大的好处是high leverage 和limited risks, 所以要善加利用这两点。如果把trading options 和trading the underlying结合起来,在运动(trading)中消灭敌人和在运动(trading)中保护自己, 这有可能是小户战胜大户的致胜之道。

http://en.wikipedia.org/wiki/Black-Scholes

You can also find many numerical methods to price options in the finance literature.

(2) If you've no time for Black and Scholes and need a quick estimate for an at-the-money call or put option, here is a simple formula.

Price = (0.4 * Volatility * Square Root(Time Ratio)) * Base Price

Time ratio is the time in years that option has until expiration. So, for a 6 month option take the square root of 0.50 (half a year).

For example: calculate the price of an ATM option @ $45 (call and put) that has 3 months until expiration. The underlying volatility is 23%.

Answer: = 0.4 * 0.23 * SQRT(.25) *$45

Option Theoretical (approx) = $2.07

(3) What Affects Equity Option Prices?

The current price of the underlying financial instrument

The strike price of the option in comparison to the current market price (intrinsic value)

The type of option (put or call)

The amount of time remaining until expiration (time value)

The current risk-free interest rate

The volatility of the underlying financial instrument

The dividend rate, if any, of the underlying financial instrument

注意不要本末倒置, 抓住重点, 才能有的放矢。

(4) 对于个人帐户, trading gamma vega theta rho....常常会十分困难, 甚至可以忽略不计, 但俺赞成在trading options前, 对这些概念最好有深入的了解。 Options are the most versatile trading instrument ever invented。 它的最大的好处是high leverage 和limited risks, 所以要善加利用这两点。如果把trading options 和trading the underlying结合起来,在运动(trading)中消灭敌人和在运动(trading)中保护自己, 这有可能是小户战胜大户的致胜之道。

Theta and Vega, example is inside

Theta is a measure of the rate of decline of option’s time-value resulting from the passage of time (time decay).

Theta provides an estimate of the dollar amount that an option price will lose each day due to the passage of time and there is no move in either the stock price or volatility.

Example:

The price of ABC May 50 Call with 25 days to expiration is $3. Its theta is -0.10. The price of ABC Jul 50 Call with 85 days to expiration is $4.8, and the theta is -0.03. When one day passes and there is no change in ABC stock price as well as the implied volatility of either options, the value of ABC May 50 Call will decrease by $0.10 to $2.9, and the value of ABC Jul 50 Call will drop by $0.03 to $4.77.

Theta of ATM, ITM & OTM Option

Theta is typically highest for ATM options, and is progressively lower as options are ITM and OTM.

This makes sense because ATM options have the highest time value component, so they have more time value to lose over time than an ITM or OTM option.

For ATM option, Theta increases as an option get closer to the expiration date.

In contrast, for ITM & OTM options, Theta decreases as an option is approaching expiration. The above effects are particularly observed in the last few weeks (about 30 days) before expiration.

The Impact of Implied Volatility (IV) and Time Remaining to Expiration on Theta

Theta (time decay) would increase sharply in the last few weeks before expiration and can severely undermine a long option holder's position, particularly if Implied Volatility (IV) is also decreasing at the same time. This is because theta is higher when either volatility is lower or there are fewer days to expiration.

Vega measures the sensitivity of an option’s price to changes in Implied Volatility (IV). Vega estimates how much an option price would change when volatility changes 1%.

Example:

The current price of ABC May 50 Call is $3, with Vega 0.20 and the volatility of ABC stock is 35%. If the volatility of ABC increases to 36%, the ABC May 50 Call’s price will rise to $3.20. If the volatility of ABC drops to 34%, the ABC May 50 Call’s value will drop to $2.80.

Vega of ATM, ITM & OTM Option

The impact of volatility changes is greater for ATM options than for the ITM & OTM options.

Vega is highest for ATM options, and is gradually lower as options are ITM and OTM.

This means that the when there is a change in volatility, the value of ATM options will change the most. This makes sense because ATM options have the highest time value component, and changes in Implied Volatility would only affect the time value portion of an option’s price.

Comparing between ITM & OTM options, the impact of volatility changes is greater for OTM options than it is for ITM options

The Impact of Time Remaining to Expiration on Vega

Assuming all other things unchanged, Vega falls when volatility drops or the option gets closer to expiration.

Vega is higher when there is more time remaining to expiration. This makes sense because options with more time remaining to expiration have larger portion of time value, and it is the time value that is affected by changes in volatility.

Theta provides an estimate of the dollar amount that an option price will lose each day due to the passage of time and there is no move in either the stock price or volatility.

Example:

The price of ABC May 50 Call with 25 days to expiration is $3. Its theta is -0.10. The price of ABC Jul 50 Call with 85 days to expiration is $4.8, and the theta is -0.03. When one day passes and there is no change in ABC stock price as well as the implied volatility of either options, the value of ABC May 50 Call will decrease by $0.10 to $2.9, and the value of ABC Jul 50 Call will drop by $0.03 to $4.77.

Theta of ATM, ITM & OTM Option

Theta is typically highest for ATM options, and is progressively lower as options are ITM and OTM.

This makes sense because ATM options have the highest time value component, so they have more time value to lose over time than an ITM or OTM option.

For ATM option, Theta increases as an option get closer to the expiration date.

In contrast, for ITM & OTM options, Theta decreases as an option is approaching expiration. The above effects are particularly observed in the last few weeks (about 30 days) before expiration.

The Impact of Implied Volatility (IV) and Time Remaining to Expiration on Theta

Theta (time decay) would increase sharply in the last few weeks before expiration and can severely undermine a long option holder's position, particularly if Implied Volatility (IV) is also decreasing at the same time. This is because theta is higher when either volatility is lower or there are fewer days to expiration.

Vega measures the sensitivity of an option’s price to changes in Implied Volatility (IV). Vega estimates how much an option price would change when volatility changes 1%.

Example:

The current price of ABC May 50 Call is $3, with Vega 0.20 and the volatility of ABC stock is 35%. If the volatility of ABC increases to 36%, the ABC May 50 Call’s price will rise to $3.20. If the volatility of ABC drops to 34%, the ABC May 50 Call’s value will drop to $2.80.

Vega of ATM, ITM & OTM Option

The impact of volatility changes is greater for ATM options than for the ITM & OTM options.

Vega is highest for ATM options, and is gradually lower as options are ITM and OTM.

This means that the when there is a change in volatility, the value of ATM options will change the most. This makes sense because ATM options have the highest time value component, and changes in Implied Volatility would only affect the time value portion of an option’s price.

Comparing between ITM & OTM options, the impact of volatility changes is greater for OTM options than it is for ITM options

The Impact of Time Remaining to Expiration on Vega

Assuming all other things unchanged, Vega falls when volatility drops or the option gets closer to expiration.

Vega is higher when there is more time remaining to expiration. This makes sense because options with more time remaining to expiration have larger portion of time value, and it is the time value that is affected by changes in volatility.

Saturday, March 8, 2008

Friday, March 7, 2008

Friday 3-7-2008

11:30 AM

This morning the job number was very bad, and Fed did something for the bond market before the number announcement. So now, the market is flat.

That is not important. The important thing for me is that there was post on hutong9.com. ppl are talking about the inflation. Since it is a very conflicting topic, I am very confused now. But one thing is clear that the baby boomer has been created tons of wealth (paper gain - dollars). Now they want to spend it. So I think this is the reason of inflationary. I need to research for it. This is really the next coming trend.

This morning the job number was very bad, and Fed did something for the bond market before the number announcement. So now, the market is flat.

That is not important. The important thing for me is that there was post on hutong9.com. ppl are talking about the inflation. Since it is a very conflicting topic, I am very confused now. But one thing is clear that the baby boomer has been created tons of wealth (paper gain - dollars). Now they want to spend it. So I think this is the reason of inflationary. I need to research for it. This is really the next coming trend.

Thursday, March 6, 2008

Economic indicators

Leading indicators

An economic indicator that changes before the economy has changed. Examples of leading indicators include production workweek, building permits, unemployment insurance claims, money supply, inventory changes, and stock prices.

Lagging indicators

An economic indicator that changes after the overall economy has changed; examples include labor costs, business spending, the unemployment rate, the prime rate, outstanding bank loans, and inventory book value.

An economic indicator that changes before the economy has changed. Examples of leading indicators include production workweek, building permits, unemployment insurance claims, money supply, inventory changes, and stock prices.

Lagging indicators

An economic indicator that changes after the overall economy has changed; examples include labor costs, business spending, the unemployment rate, the prime rate, outstanding bank loans, and inventory book value.

Thursday 3-6-2008

8:40 AM

Ever since Buffett talked about US in recession, the market's tone is totally confirmed. The direction of the market is much clearer than before. Long journal in the bear market. Yesterday, the market waited for the ambac bailout news which was not exciting. The bail out is small and not enough. Now the future is down a lot.

Ever since Buffett talked about US in recession, the market's tone is totally confirmed. The direction of the market is much clearer than before. Long journal in the bear market. Yesterday, the market waited for the ambac bailout news which was not exciting. The bail out is small and not enough. Now the future is down a lot.

Wednesday, March 5, 2008

Wednesday 3-5-2008

11:00 AM

Today's market is worth to be recorded. Yesterday, the indices (NDX) broke the downtrend line. At one time, around 1:30 pm, the DOW was down -200 pts. But in the last 1.5 hours trade, the market moved up and closed flat. So yesterday was a turnaround day. But all the indicators point no bottom yet.

This morning, the market got some "good" news, that the ISM service reading was better than expected (but still in contraction mode). One of the largest bond insurer is getting help and about to settle soon. So I guess that market is waiting for this news and heading higher.

My play is to add short positions on the news. Let it play out first. The timing might be either tomorrow morning, or on Friday.

Today's market is worth to be recorded. Yesterday, the indices (NDX) broke the downtrend line. At one time, around 1:30 pm, the DOW was down -200 pts. But in the last 1.5 hours trade, the market moved up and closed flat. So yesterday was a turnaround day. But all the indicators point no bottom yet.

This morning, the market got some "good" news, that the ISM service reading was better than expected (but still in contraction mode). One of the largest bond insurer is getting help and about to settle soon. So I guess that market is waiting for this news and heading higher.

My play is to add short positions on the news. Let it play out first. The timing might be either tomorrow morning, or on Friday.

Tuesday, March 4, 2008

Tuesday 3/4/2008

9:15 AM

After Friday's big down and yesterday's weak pause, today's future is down again. The trend is very clear. I had sold QID, SDS, and 1/2 puts options way too early. Here I believe the building heavy construction (engineering and contructions) stocks will have a good down turn. So I will looking into KBR and PWR to short.

After Friday's big down and yesterday's weak pause, today's future is down again. The trend is very clear. I had sold QID, SDS, and 1/2 puts options way too early. Here I believe the building heavy construction (engineering and contructions) stocks will have a good down turn. So I will looking into KBR and PWR to short.

Monday, March 3, 2008

Monday 3/3/2008

12:30 AM

The market had a lower future, but opened flat, went down about 100 pts, now it is flat again. Overall, due to the large sell off -300 on last Friday. This action should be the continous confirmation. Seeking for some point to reload the short positions.

The market had a lower future, but opened flat, went down about 100 pts, now it is flat again. Overall, due to the large sell off -300 on last Friday. This action should be the continous confirmation. Seeking for some point to reload the short positions.

Tuesday, February 26, 2008

Tuesday 2-26-2008

7:30 AM

The future is flat. I think that the refinary WNR is forming a good bottom here. Do some research.

The future is flat. I think that the refinary WNR is forming a good bottom here. Do some research.

Monday, February 25, 2008

Monday 2-25-2008

9:30 AM

Last Friday was very interesting. The market was going to the down direction for almost the whole day. But in that last half hours, it gave up the down trend, moved up, and closed at around +100 pts on the news of ABK will be bailed out by the banks.

This morning, the market is flat. GS downgraded many banks. Lowes earning is very bad.

Last Friday was very interesting. The market was going to the down direction for almost the whole day. But in that last half hours, it gave up the down trend, moved up, and closed at around +100 pts on the news of ABK will be bailed out by the banks.

This morning, the market is flat. GS downgraded many banks. Lowes earning is very bad.

Sunday, February 24, 2008

公司培训时提供的参考网址--很有用的!

Note:*:推荐**: 重点推荐

Technical analysis associations

IFIA: www.ifta.org

MTA: www.mata.org

Education

Candlecharts: www.candlecharts.com

Candlestick: www.candlestickshop.com/glossary

Day trading university: www.daytradinguniversity.com

Decision point: www.decisionpoint.com/tacourse/tacoursemenu.html

Dorsey wright and associates: www.dorseywright.com

Alexander elder*: www.elder.com

E-analytics: www.e-analytics.com

Equis: www.equis.com/free/taaz

Litwick: www.litwick.com/glossary

Market mavens: www.marketmavens.com

Marketwise trading school*: www.marketwise.com

Momentum trading: www.mtrader.com

Murphy morris*: www.murphymorris.com

Pristine: www.stockcharts.com/

Stock charts: www.stockcharts.com/eduction

Stock & commodities magazine: www.traders.com

Traders book press: www.traderspress.com

Trading tutor ( larry pesavento ): www.tradingtutour.com

Gann and cycle analysis

Aerodynamic investment**: www.aeroinvest.com

Calendar research: www.aeroinvest.com

Stock market geometry: www.cycle-trader.comIndicators

Bollinger bands*: www.bollingerbands.com

Fibonacci indicators: www.fibonaccitrader.com

SentimentConsensus: www.consensus-inc.com

Erlanger short rank: www.erlangersqueezeplay.com

Market vane*: www.marketvane.net

Schaeffer`s research: www.schaeffersearch.com

VolumeMarket volume: www.marketvolume.com

Pattern recognition

Investtech: www.investtech.com

Data

Chicago board of trade: www.cbot.com

Chicago board options exchange: www.cboe.com

Commodity futures trading commission: www.cftc.gov

Chicago mercantile exchange: www.cme.com

Commitment of traders: www.commitmentoftrders.com

Commodity research bureau: www.crbtrader.com

End-of-day data(free downloads): www.eoddata.com

Opec: www.opec.org

Statistics Canada: www.statcan.ca

World golg council: www.gold.org

Charting

Barchart: www.barchart.com

Bigcharts: www.bigcharts.com

Dorsey wright and associates: www.dorseywright.com

Incredible charts: www.incrediblecharts.com/site_map.htm

E-signal: www.esognl.com

FX-trek: www.fxtrek.com

Litwick candlestick analysis: www.litwick.com/glossary

Stockcharts: www.stockcharts.com

Stockpoint: www.stockpoint.com

Elliott wave

Aerodynamic investments: www.aeroinvest.com

Elliott wave international: www.elliottwave.com

Bonds

Bond market association: www.bondmarket.com

Bond talk: www.bondtalk.com

Technical analysis associations

IFIA: www.ifta.org

MTA: www.mata.org

Education

Candlecharts: www.candlecharts.com

Candlestick: www.candlestickshop.com/glossary

Day trading university: www.daytradinguniversity.com

Decision point: www.decisionpoint.com/tacourse/tacoursemenu.html

Dorsey wright and associates: www.dorseywright.com

Alexander elder*: www.elder.com

E-analytics: www.e-analytics.com

Equis: www.equis.com/free/taaz

Litwick: www.litwick.com/glossary

Market mavens: www.marketmavens.com

Marketwise trading school*: www.marketwise.com

Momentum trading: www.mtrader.com

Murphy morris*: www.murphymorris.com

Pristine: www.stockcharts.com/

Stock charts: www.stockcharts.com/eduction

Stock & commodities magazine: www.traders.com

Traders book press: www.traderspress.com

Trading tutor ( larry pesavento ): www.tradingtutour.com

Gann and cycle analysis

Aerodynamic investment**: www.aeroinvest.com

Calendar research: www.aeroinvest.com

Stock market geometry: www.cycle-trader.comIndicators

Bollinger bands*: www.bollingerbands.com

Fibonacci indicators: www.fibonaccitrader.com

SentimentConsensus: www.consensus-inc.com

Erlanger short rank: www.erlangersqueezeplay.com

Market vane*: www.marketvane.net

Schaeffer`s research: www.schaeffersearch.com

VolumeMarket volume: www.marketvolume.com

Pattern recognition

Investtech: www.investtech.com

Data

Chicago board of trade: www.cbot.com

Chicago board options exchange: www.cboe.com

Commodity futures trading commission: www.cftc.gov

Chicago mercantile exchange: www.cme.com

Commitment of traders: www.commitmentoftrders.com

Commodity research bureau: www.crbtrader.com

End-of-day data(free downloads): www.eoddata.com

Opec: www.opec.org

Statistics Canada: www.statcan.ca

World golg council: www.gold.org

Charting

Barchart: www.barchart.com

Bigcharts: www.bigcharts.com

Dorsey wright and associates: www.dorseywright.com

Incredible charts: www.incrediblecharts.com/site_map.htm

E-signal: www.esognl.com

FX-trek: www.fxtrek.com

Litwick candlestick analysis: www.litwick.com/glossary

Stockcharts: www.stockcharts.com

Stockpoint: www.stockpoint.com

Elliott wave

Aerodynamic investments: www.aeroinvest.com

Elliott wave international: www.elliottwave.com

Bonds

Bond market association: www.bondmarket.com

Bond talk: www.bondtalk.com

Thursday, February 21, 2008

Thursday 2-21-2008

9:30 AM

The pre-market was up huge. The market is in the break out phase of triangle formation. Everybody was nervous due to its magnitude of 5% swing. Due to my amaturity, my positions are all on the short side. So I have to wait and see, or just sit dead. Anyway, all I can do is hope.

The pre-market was up huge. The market is in the break out phase of triangle formation. Everybody was nervous due to its magnitude of 5% swing. Due to my amaturity, my positions are all on the short side. So I have to wait and see, or just sit dead. Anyway, all I can do is hope.

Wednesday, February 20, 2008

Wednesday 2-20-2008

10:30 AM

The market is in a down direction. The CPI number is not good. Meanwhile, the housing starts numbers are not bad. But overall, the CPI number over weighs. So the market is going down. The TA supports this movement.

The sentiment is that many bulls don't believe it as the major trend line hasn't been broken yet. We should see.

The market is in a down direction. The CPI number is not good. Meanwhile, the housing starts numbers are not bad. But overall, the CPI number over weighs. So the market is going down. The TA supports this movement.

The sentiment is that many bulls don't believe it as the major trend line hasn't been broken yet. We should see.

Tuesday, February 19, 2008

Tuesday 2-19-2008

9:30 AM

The future market shows a higher opening. All indices are up more than 1.25%. But they are still in the triangle zone. The up line is 1368 for the S&P. If it breaks this line, I expect the market will do A-B-C. Otherwise, that market will trade within the triangle.

12:00 PM

So far, the market is still trapped in that triangle. The buying power is very weak. Shyuan on DQ and Hutong9.com is a very good researcher. He concludes that in major events, hedge funds preset positions. If those positions can't make profit, the next day, they will try to make the market move so that these positions can escape. He observed the events on Dec 11 (Fed rate cut) & 12, and Jan 31 & Fed 1.

Now, I believe it happened again. Last Friday was OE day, and those hedge funds hoping for a huge up day. So they preseat long positions. Unfortunately, there was no short-covering and lack of buying. Those positions are lossing money. So this morning, they moved the market in order to escape. Based on this, I expect the market will make big movement (down) soon.

The future market shows a higher opening. All indices are up more than 1.25%. But they are still in the triangle zone. The up line is 1368 for the S&P. If it breaks this line, I expect the market will do A-B-C. Otherwise, that market will trade within the triangle.

12:00 PM

So far, the market is still trapped in that triangle. The buying power is very weak. Shyuan on DQ and Hutong9.com is a very good researcher. He concludes that in major events, hedge funds preset positions. If those positions can't make profit, the next day, they will try to make the market move so that these positions can escape. He observed the events on Dec 11 (Fed rate cut) & 12, and Jan 31 & Fed 1.

Now, I believe it happened again. Last Friday was OE day, and those hedge funds hoping for a huge up day. So they preseat long positions. Unfortunately, there was no short-covering and lack of buying. Those positions are lossing money. So this morning, they moved the market in order to escape. Based on this, I expect the market will make big movement (down) soon.

Friday, February 15, 2008

Friday 2-15-2008

7:30 AM

The market had a decent sell off yesterday, from open to close. The bond insurers were down graded, which started a couple of weeks ago. This sell off took back all the gains on Wednesday. The volume is heavier than relative low volumes while the market was moving up. Today is the OE day, so I expect the market either stall or downwards as I saw the put/call open interests is high, I still think since the puts are traded by the MMs, they want to make money.

The market had a decent sell off yesterday, from open to close. The bond insurers were down graded, which started a couple of weeks ago. This sell off took back all the gains on Wednesday. The volume is heavier than relative low volumes while the market was moving up. Today is the OE day, so I expect the market either stall or downwards as I saw the put/call open interests is high, I still think since the puts are traded by the MMs, they want to make money.

Wednesday, February 13, 2008

Wednesday 2-13-2008

11:30 AM

The Jan retails sales was okay up .3% as expect, which pushed all indices higher. Dow was up more than 100 pts, now it is around 70s. The overall sentiment is still bearish. I am holding all short positions.

The Jan retails sales was okay up .3% as expect, which pushed all indices higher. Dow was up more than 100 pts, now it is around 70s. The overall sentiment is still bearish. I am holding all short positions.

Tuesday, February 12, 2008

Tuesday 2-12-2008

9:45 AM

Buffet started investing into bond insurers. The market gapped up. Again, nothing has been changed so far. The short term is up, and mid term is down. SO I am still on one side play.

Buffet started investing into bond insurers. The market gapped up. Again, nothing has been changed so far. The short term is up, and mid term is down. SO I am still on one side play.

Monday, February 11, 2008

Monday 2-11-2008

2:30 PM

The market opened low, went low, and now it goes up, and making a horizontal S. Since this market is heading lower, I have to play on one side. I have closed all the long positions, and heavily shorted the market right now.

The market opened low, went low, and now it goes up, and making a horizontal S. Since this market is heading lower, I have to play on one side. I have closed all the long positions, and heavily shorted the market right now.

Sunday, February 10, 2008

Weekend 2-10-2008

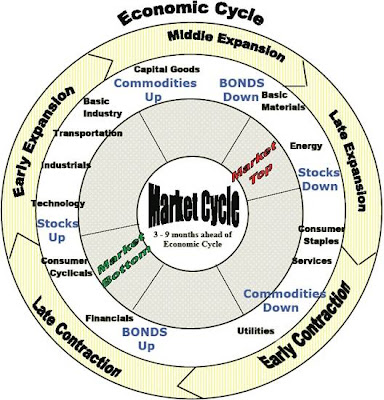

There are 5 stage of economy cycle, they are contraction: 1. early; 2. late, expansion: 1. early; 2. middle; 3. late. We are at early stage of contraction. The market has been down since Oct 2007 for 4 months. It matches the chart from Sep 2000 to Jan 2001 on S&P. This also marks the 1945-1996 statistics data on average down percentage. So it might start a pause and watch phase. Also the average down trend based on the history data is 7 months.

Therefore, I will have to pause and watch too. In the next 3 months, the market can go either ways for the short term. But the mid/long term trend is still down. I expect there will be another leg down. So the bias is to play the down trend for new low. After that, there might be a mid term rally, followed by a mid/long term down turn to retest the new low during or after summer time. Then we will have a huge leg up to close near flat for the whole year.

Therefore, I will have to pause and watch too. In the next 3 months, the market can go either ways for the short term. But the mid/long term trend is still down. I expect there will be another leg down. So the bias is to play the down trend for new low. After that, there might be a mid term rally, followed by a mid/long term down turn to retest the new low during or after summer time. Then we will have a huge leg up to close near flat for the whole year.

Friday, February 8, 2008

Friday 2-9-2008

5:30 PM

The market was up and down, but moving no where. So it is clear that it is consolidation. The trend is very clear now, that the market wants to go down. NO long positions only for a little bit of hedge. Short whenever it goes higher.

The market was up and down, but moving no where. So it is clear that it is consolidation. The trend is very clear now, that the market wants to go down. NO long positions only for a little bit of hedge. Short whenever it goes higher.

Thursday, February 7, 2008

Wednesday 2-6-2008

9:20 Am

Yesterday was a big reverse day (continuation day -down trend). I have sold all the shorts, and loaded 1/3 positions of shorts, which was a very bad move.

I do have some problems with these type of days. I think the easy way to avoid is that once positions are cleared, don't jump in too quick. Wait out side and watch for a while see if there is any clear picture. That is to wait for the whole day till next day to see the direction.

This morning, the future is way down. Let's see how it plays out. S&P 1315 (SPY 131.18) is the 61.8% retrace from current up leg - A leg. If it breaks, the Jan low will be re-tested. I will load 100 shares of SSO at SPY $131.18 and QLD at QQQQ $41.60.

Yesterday was a big reverse day (continuation day -down trend). I have sold all the shorts, and loaded 1/3 positions of shorts, which was a very bad move.

I do have some problems with these type of days. I think the easy way to avoid is that once positions are cleared, don't jump in too quick. Wait out side and watch for a while see if there is any clear picture. That is to wait for the whole day till next day to see the direction.

This morning, the future is way down. Let's see how it plays out. S&P 1315 (SPY 131.18) is the 61.8% retrace from current up leg - A leg. If it breaks, the Jan low will be re-tested. I will load 100 shares of SSO at SPY $131.18 and QLD at QQQQ $41.60.

Tuesday, February 5, 2008

Tuesday 2-5-2008

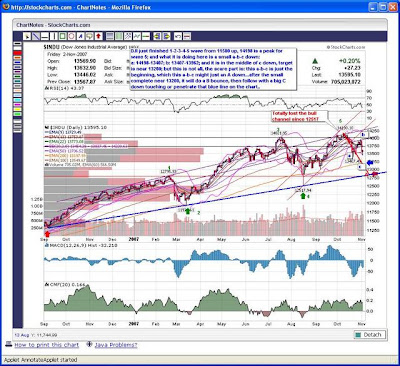

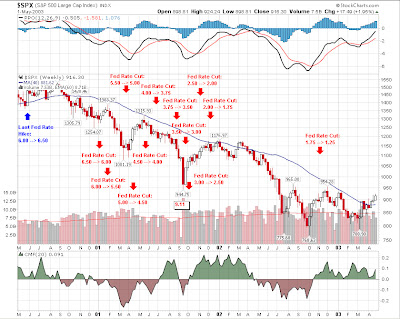

2 chart of S&P during 2000-2001 and 2007-2008. Each one has the fed rate cut.

2 chart of S&P during 2000-2001 and 2007-2008. Each one has the fed rate cut.9:00 AM

Yesterday, the market went down more than 100 pts. It is a sizable down. Today, the future is down a lot. The current correction wave of A-B-C is starting at B wave down. The current A wave up in S&P is 1400-1370 = 130 points. The B correction is looking at 38.2% of 130 pts, which is, S&P at 1350 level.

Yesterday, the market went down more than 100 pts. It is a sizable down. Today, the future is down a lot. The current correction wave of A-B-C is starting at B wave down. The current A wave up in S&P is 1400-1370 = 130 points. The B correction is looking at 38.2% of 130 pts, which is, S&P at 1350 level.

12:45 PM

The S&P 1350 level is broken. Now, I am looking at S&P 1320 level. I believe that since the news - Service segment in recession, is so huge that the 1st lvl of support should be broken. Plus the today's volumes are above average in the wake of yesterday's 2/3 of normal volumes. The sell is intensifying.

Monday, February 4, 2008

Monday 2-4-2008

11:30 AM

The last 2 days were volatile, both went up in a big size. In both of the days, the market went down over 100 pts in the morning, and came back with more than 100 points gain in the afternoon. Basically, I marked them distribution days.

This morning, the pre-market was flat. Now it is down on .5% average. I guess it either starts the A-B-C wave B leg or rolling down. We should see it clearly. If the market close flat, I am gonna lean towards the rollover formation. If the market close sizable down, I will think this is the B leg down. If the market goes up. I will add short position.

The last 2 days were volatile, both went up in a big size. In both of the days, the market went down over 100 pts in the morning, and came back with more than 100 points gain in the afternoon. Basically, I marked them distribution days.

This morning, the pre-market was flat. Now it is down on .5% average. I guess it either starts the A-B-C wave B leg or rolling down. We should see it clearly. If the market close flat, I am gonna lean towards the rollover formation. If the market close sizable down, I will think this is the B leg down. If the market goes up. I will add short position.

Thursday, January 31, 2008

Thursday 1-31-2008

9:20 AM

The future is down huge. It is the revenge of yesterday roll-over. Don't watch the market too closely today. Let it run. Watch spy 132, QQQQ 43.25, XHB 18.6, XLF 26.75. If they reach, consider unload short positions.

The future is down huge. It is the revenge of yesterday roll-over. Don't watch the market too closely today. Let it run. Watch spy 132, QQQQ 43.25, XHB 18.6, XLF 26.75. If they reach, consider unload short positions.

Wednesday, January 30, 2008

Wednesday 1-30-2008

10:00 AM

The future was down .5%, it gapped open, now it is fading the gap. I think that market will go lower from now. But from now to the fed decision, it should trade in a narrow range.

8:30 PM

Fed cut rate 50 base points. The market went up 200 points, then moved down and wiped all the gain. It made a huge reverse.

The future was down .5%, it gapped open, now it is fading the gap. I think that market will go lower from now. But from now to the fed decision, it should trade in a narrow range.

8:30 PM

Fed cut rate 50 base points. The market went up 200 points, then moved down and wiped all the gain. It made a huge reverse.

Tuesday, January 29, 2008

Tuesday 1-29-2008

12:00 AM

The market opened high and going swings. At this moment, I really don't have a crystal ball. But it is going up to a level that is critical for long positions. So I am unloading all the longs at this level, and go long if it can break up. Otherwise, I will add short positions, if it goes down. Today's close will tell more.

2:20 PM

Today's action is swing up and down with a flag formation. Since it happened at the relative high level, I treat it as smart money selling signal. So I have unloaded all long positions with only 100 share of SSO left. My theory is that the current market low needs to be re-tested before any major upside movement happens.

The market opened high and going swings. At this moment, I really don't have a crystal ball. But it is going up to a level that is critical for long positions. So I am unloading all the longs at this level, and go long if it can break up. Otherwise, I will add short positions, if it goes down. Today's close will tell more.

2:20 PM

Today's action is swing up and down with a flag formation. Since it happened at the relative high level, I treat it as smart money selling signal. So I have unloaded all long positions with only 100 share of SSO left. My theory is that the current market low needs to be re-tested before any major upside movement happens.

Monday, January 28, 2008

Monday 1-28-2008

9:00 AM

The oversea market is sold off. China market down another 7%. Today's future market was lower, and now is improving. I believe a re-test to 50% retrace level is for sure. So just wait for a few minutes after the open for the uptrend to finish, then long puts on spy. There will be at a certain point, the low will show, by then, cover all the put positions, and leave short positions. If any strong can be felt, add long QLD positions.

2:25 PM

The market made a temp bottom and went up. I missed the obvious double bottom and had to hold all the short positions. There are a couple of reasons, but the major one was that I didn't pay too much attention on the double bottom and had a preemptive assumption/line/level, which is totally wrong.

The oversea market is sold off. China market down another 7%. Today's future market was lower, and now is improving. I believe a re-test to 50% retrace level is for sure. So just wait for a few minutes after the open for the uptrend to finish, then long puts on spy. There will be at a certain point, the low will show, by then, cover all the put positions, and leave short positions. If any strong can be felt, add long QLD positions.

2:25 PM