Saturday, August 22, 2009

Sunday, March 15, 2009

Saturday, March 7, 2009

Thursday, March 5, 2009

Status Quote and Future

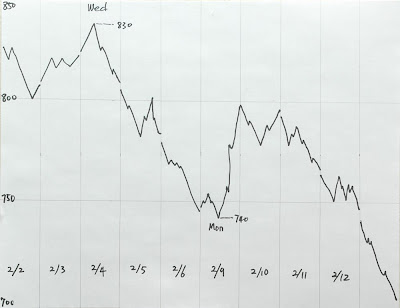

The market has been down around 55% from the top. If the history can be any reference, it is in the time of April 24-25, 1931. If you look at the chart from April 1931 to the bottom July 1932. This is the top of the market in next 2 years. It didn't reach the same level until Nov, 1937, which is about 5.5 years. So I think from now on, no longs. And short when ever the market goes higher.

Monday, March 2, 2009

Tuesday, February 17, 2009

Here’s another brutal look at where P/E rations might end up going before this is all over, via Bob Bronson:

I am very skeptical of earnings forecasts, because they have been so terrible for most of my adult life. The conspiracy of optimists always seems to overestimate future earnings.

Trailing earnings are real data, not opinion of guesswork. They provide a factual basis for valuation, and not a wishful or theoretical version. Those who were claiming that there is no recession have now taken to saying we are at the worst levels of the recession. Often, we see forward earnings estimates at the heart of this faulty analysis.

Forward earnings guesswork are why the analyst community missed the credit crisis, why they could expected a 20% Q3, and 50% Q4 earnings rebound. Hence, the forward earnings consensus led to calls for 1350 and even 1550 on the S&P . . . Its now about half of that.

Rather than rely on Wall Street Analysts who are chock full of the conflicts, and seem structurally incapable of catching major economic turns, let’s revisit a long term look at P/E ratios, via historical cycles.

Sunday, February 1, 2009

Thursday, December 18, 2008

10 Outrageous Predictions for 2009

No Growth in China and other Outrageous Prophecies

STOCKS, ECONOMY, CURRENCIES, POLITICS, 2009

CNBC.com | 18 Dec 2008 | 02:03 AM ET

This year has been marked by astonishing and market-changing events including a $100 fall in the price of oil, the drop to zero of U.S. interest rates and the collapse of Wall Street giants such as Lehman Brothers.

Next year could bring more, equally unbelievable, happenings such as another 400 points being wiped off the S&P 500 and a slump in Chinese growth to zero, according to a report from Saxo Bank titled “10 Outrageous Claims 2009.”

Video: David Karsbol, markets strategist from Saxo Bank, spoke to CNBC about the predictions.

1. Iranian Revolution

If oil prices continue to decline, which Saxo Bank believes they will, the Iranian society will be badly affected due to the country’s reliance on its number one commodity. The government may not be able to provide the basic necessities its citizens need, which would lead to widespread social unrest, according to Saxo Bank.

2. Crude Oil to $25

The ongoing economic crisis will further dent oil demand throughout next year, sending the price ever closer to $25 a barrel, Saxo Bank said. OPEC production cuts will be hampered by disagreement and fail to stem the slide, it added.

3. S&P 500 to 500

The S&P 500 will fall to 500 points in 2009 as slowing corporate earnings will drag on the U.S. index, according to Saxo Bank. Earnings will slow because of a continued consumer recession, lead by the credit shortage. An increase in corporate funding costs, falls in house prices and a slowdown in investing programs will also add to the weakness, the report said.

4. Italy Could Drop the Euro

Italy could make good on threats to leave the European Exchange Rate Mechanism (ERM) and may drop out in 2009, Saxo Bank said, a decision which would mean the country effectively gives up the euro. The EU is likely to crack down on excessive government budget deficits, which could prompt Italy to leave the currency regulation, it said.

5. Australian Dollar to Slump vs Yen

The Australian dollar will sink to 40 Japanese yen as next year’s continued slump in commodities hurts the Australian economy, Saxo Bank said. The whole commodity complex will be left dead in the water for the next ten years, the report said.

6. Dollar to Outstrip the Euro

The euro will fall to 0.95 cents versus the dollar in the New Year, before shifting direction and rising to 1.30 cents, according to Saxo Bank. The euro-zone will face a tough year in 2009 as the banking sector will suffer because of its exposure to Eastern Europe, a region that will increasingly falter next year, the report said.

7. Chinese GDP Growth to 0%

Export-led China will be hit by the double blow of a slowing U.S. economy and the souring of commodity-based investments, according to Saxo Bank. Japan will not actually sink into recession, despite gross-domestic-product growth all but disappearing, the report said.

8. Eastern European Forex Pegs to Fail

Several of the Eastern European currencies currently pegged or semi-pegged to the euro will come under increasing pressure to decouple next year, the report said. The emerging economies are vulnerable to more credit-market disruptions, it added.

9. Commodities Prices to Plunge

Commodities are facing widespread weakness next year with the Reuters/Jefferies CRB Index to drop 30 percent, according to Saxo Bank. The consensus belief that demand has been outstripping supply for years might not even be true and more stockpiles could be revealed, the report said.

10. Yen to Become Currency Peg

Asian countries could shun dollar pegs in favor of the Chinese yen next year, according to Saxo Bank. China’s economic, political and cultural influence is growing and shifts in market re-evaluations will favor the country, the report added.

STOCKS, ECONOMY, CURRENCIES, POLITICS, 2009

CNBC.com | 18 Dec 2008 | 02:03 AM ET

This year has been marked by astonishing and market-changing events including a $100 fall in the price of oil, the drop to zero of U.S. interest rates and the collapse of Wall Street giants such as Lehman Brothers.

Next year could bring more, equally unbelievable, happenings such as another 400 points being wiped off the S&P 500 and a slump in Chinese growth to zero, according to a report from Saxo Bank titled “10 Outrageous Claims 2009.”

Video: David Karsbol, markets strategist from Saxo Bank, spoke to CNBC about the predictions.

1. Iranian Revolution

If oil prices continue to decline, which Saxo Bank believes they will, the Iranian society will be badly affected due to the country’s reliance on its number one commodity. The government may not be able to provide the basic necessities its citizens need, which would lead to widespread social unrest, according to Saxo Bank.

2. Crude Oil to $25

The ongoing economic crisis will further dent oil demand throughout next year, sending the price ever closer to $25 a barrel, Saxo Bank said. OPEC production cuts will be hampered by disagreement and fail to stem the slide, it added.

3. S&P 500 to 500

The S&P 500 will fall to 500 points in 2009 as slowing corporate earnings will drag on the U.S. index, according to Saxo Bank. Earnings will slow because of a continued consumer recession, lead by the credit shortage. An increase in corporate funding costs, falls in house prices and a slowdown in investing programs will also add to the weakness, the report said.

4. Italy Could Drop the Euro

Italy could make good on threats to leave the European Exchange Rate Mechanism (ERM) and may drop out in 2009, Saxo Bank said, a decision which would mean the country effectively gives up the euro. The EU is likely to crack down on excessive government budget deficits, which could prompt Italy to leave the currency regulation, it said.

5. Australian Dollar to Slump vs Yen

The Australian dollar will sink to 40 Japanese yen as next year’s continued slump in commodities hurts the Australian economy, Saxo Bank said. The whole commodity complex will be left dead in the water for the next ten years, the report said.

6. Dollar to Outstrip the Euro

The euro will fall to 0.95 cents versus the dollar in the New Year, before shifting direction and rising to 1.30 cents, according to Saxo Bank. The euro-zone will face a tough year in 2009 as the banking sector will suffer because of its exposure to Eastern Europe, a region that will increasingly falter next year, the report said.

7. Chinese GDP Growth to 0%

Export-led China will be hit by the double blow of a slowing U.S. economy and the souring of commodity-based investments, according to Saxo Bank. Japan will not actually sink into recession, despite gross-domestic-product growth all but disappearing, the report said.

8. Eastern European Forex Pegs to Fail

Several of the Eastern European currencies currently pegged or semi-pegged to the euro will come under increasing pressure to decouple next year, the report said. The emerging economies are vulnerable to more credit-market disruptions, it added.

9. Commodities Prices to Plunge

Commodities are facing widespread weakness next year with the Reuters/Jefferies CRB Index to drop 30 percent, according to Saxo Bank. The consensus belief that demand has been outstripping supply for years might not even be true and more stockpiles could be revealed, the report said.

10. Yen to Become Currency Peg

Asian countries could shun dollar pegs in favor of the Chinese yen next year, according to Saxo Bank. China’s economic, political and cultural influence is growing and shifts in market re-evaluations will favor the country, the report added.

Thursday, November 6, 2008

Barack Obama ETF Portfolio Sector ETFs

Consumer Discretionary Consumer Discretionary Select Sector SPDR XLY

Hospital Managers and Medicaid Companies iShares Dow Jones U. S. Healthcare Providers IHF

Natural Gas United States Natural Gas UNG

Solar Power Market Vectors Solar Energy KWT

Wind Power First Trust Global Wind Energy FAN

Hospital Managers and Medicaid Companies iShares Dow Jones U. S. Healthcare Providers IHF

Natural Gas United States Natural Gas UNG

Solar Power Market Vectors Solar Energy KWT

Wind Power First Trust Global Wind Energy FAN

Wednesday, October 8, 2008

Oct 2008

I want to record the historical event here so that I can refer:

Starting from Oct, 2008, right after the 700B bailout got approved by the house for the 2nd time, the market tumbled. Within 5 days, market went on free fall. It dropped more than 16% in a roll.

The economic all sudden stopped running. The credit crisis starts with nobody (banks) wanted to lend with each other. I was adding long positions like crazy. Now I am all underwater.

Starting from Oct, 2008, right after the 700B bailout got approved by the house for the 2nd time, the market tumbled. Within 5 days, market went on free fall. It dropped more than 16% in a roll.

The economic all sudden stopped running. The credit crisis starts with nobody (banks) wanted to lend with each other. I was adding long positions like crazy. Now I am all underwater.

Friday, October 3, 2008

FEED

Friday, market went up 300 pts then nosed down to -150. All Ren's holdings are underwater.

Michelle was just panic and peeled to her pants. She wanted to sell everything, especially FEED. She thinks FEED would not be able to get back to buying level for very long time. She suggested to sell and change to something else such as MOS, FRO.

MOS -- $40.8

FRO -- $42

Michelle was just panic and peeled to her pants. She wanted to sell everything, especially FEED. She thinks FEED would not be able to get back to buying level for very long time. She suggested to sell and change to something else such as MOS, FRO.

MOS -- $40.8

FRO -- $42

Tuesday, September 30, 2008

History has been made

Yesterday, 9/29/2008, Dow down 777 pts. Today's action:

1. Buy BPT 100 shares each in Roths;

2. Average down UYG 200 shares;

3. Average down SSO 200 shares;

4. Average down 100 shares of FRO & Sell SPY puts in r2y.

1. Buy BPT 100 shares each in Roths;

2. Average down UYG 200 shares;

3. Average down SSO 200 shares;

4. Average down 100 shares of FRO & Sell SPY puts in r2y.

Tuesday, September 23, 2008

building up a profitable portfolio

1. renshan2: DBA & GDX holding with option play.

2. renshan2735: UNG, DUK, and SPY trade

3. r2y: FRO & FEED & LKQX holding, option play

4. roth: BPT

5. sep: DUK

2. renshan2735: UNG, DUK, and SPY trade

3. r2y: FRO & FEED & LKQX holding, option play

4. roth: BPT

5. sep: DUK

Monday, September 22, 2008

Friday, September 19, 2008

Subscribe to:

Comments (Atom)