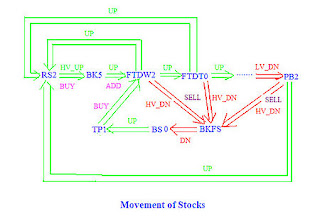

Seven states are defined in my model:

TP1 : Turing Point, the stock maybe begin a uptrend from its bottom. If volume is heavy then buy only 10% to test the water. If it's right, then keep it. You will catch the fish tail( hope to eat all the way up to the head). If fails then sell it right way, you have minimum loss.

FTDW2: Follow Through Day One, the trend is a little bit clear so add 20% more.

FTDT0: Follow Through Day Two, stock continues going up but the risk of going down also picking up so do nothing at this time.

RS2: Stock approaches major resistance but still could not break out. You could add 20% more if it looks like it will break out from here some day.

BK5: This is the time to build your position if the stock finally breaks out with heavy volume. Don't hesitate to get in.Otherwise you will miss a fast moving train. But if it is a fake breakout you must sell it right way.

PB2: After breakout, some stock will have a light volume pull back. This is the best time to add more to your positionBKFS: Breakout Failure Sell All. If the stock could not follow through in the following days and it break down with very heavy volume then sell them all at once.

BS0: Basing Zero. The stock is trading flat between the support and resistant zone. No action should be taken during this state. Otherwise you'll lose money. I have developed my own system to track stocks in the above movement and it proves working very good so far. All the stocks are divided automatically by my system and I only focus TP1 and BK5 to buy stocks and BKFS to sell stocks. This saves me a lot of time and I could focus on Buy and Sell. The above mentioned reverse pyramid method to build up position is copied from an Econ professor in Berkley University who quit his job and trading full time later.

No comments:

Post a Comment