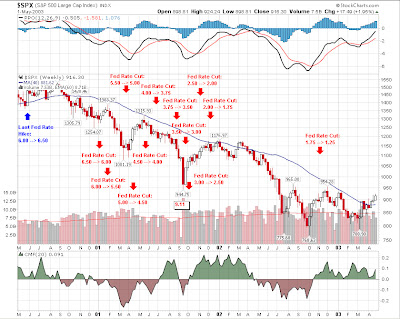

2 chart of S&P during 2000-2001 and 2007-2008. Each one has the fed rate cut.

2 chart of S&P during 2000-2001 and 2007-2008. Each one has the fed rate cut.9:00 AM

Yesterday, the market went down more than 100 pts. It is a sizable down. Today, the future is down a lot. The current correction wave of A-B-C is starting at B wave down. The current A wave up in S&P is 1400-1370 = 130 points. The B correction is looking at 38.2% of 130 pts, which is, S&P at 1350 level.

Yesterday, the market went down more than 100 pts. It is a sizable down. Today, the future is down a lot. The current correction wave of A-B-C is starting at B wave down. The current A wave up in S&P is 1400-1370 = 130 points. The B correction is looking at 38.2% of 130 pts, which is, S&P at 1350 level.

12:45 PM

The S&P 1350 level is broken. Now, I am looking at S&P 1320 level. I believe that since the news - Service segment in recession, is so huge that the 1st lvl of support should be broken. Plus the today's volumes are above average in the wake of yesterday's 2/3 of normal volumes. The sell is intensifying.

No comments:

Post a Comment