7:30 AM

The future is flat. I think that the refinary WNR is forming a good bottom here. Do some research.

Tuesday, February 26, 2008

Monday, February 25, 2008

Monday 2-25-2008

9:30 AM

Last Friday was very interesting. The market was going to the down direction for almost the whole day. But in that last half hours, it gave up the down trend, moved up, and closed at around +100 pts on the news of ABK will be bailed out by the banks.

This morning, the market is flat. GS downgraded many banks. Lowes earning is very bad.

Last Friday was very interesting. The market was going to the down direction for almost the whole day. But in that last half hours, it gave up the down trend, moved up, and closed at around +100 pts on the news of ABK will be bailed out by the banks.

This morning, the market is flat. GS downgraded many banks. Lowes earning is very bad.

Sunday, February 24, 2008

公司培训时提供的参考网址--很有用的!

Note:*:推荐**: 重点推荐

Technical analysis associations

IFIA: www.ifta.org

MTA: www.mata.org

Education

Candlecharts: www.candlecharts.com

Candlestick: www.candlestickshop.com/glossary

Day trading university: www.daytradinguniversity.com

Decision point: www.decisionpoint.com/tacourse/tacoursemenu.html

Dorsey wright and associates: www.dorseywright.com

Alexander elder*: www.elder.com

E-analytics: www.e-analytics.com

Equis: www.equis.com/free/taaz

Litwick: www.litwick.com/glossary

Market mavens: www.marketmavens.com

Marketwise trading school*: www.marketwise.com

Momentum trading: www.mtrader.com

Murphy morris*: www.murphymorris.com

Pristine: www.stockcharts.com/

Stock charts: www.stockcharts.com/eduction

Stock & commodities magazine: www.traders.com

Traders book press: www.traderspress.com

Trading tutor ( larry pesavento ): www.tradingtutour.com

Gann and cycle analysis

Aerodynamic investment**: www.aeroinvest.com

Calendar research: www.aeroinvest.com

Stock market geometry: www.cycle-trader.comIndicators

Bollinger bands*: www.bollingerbands.com

Fibonacci indicators: www.fibonaccitrader.com

SentimentConsensus: www.consensus-inc.com

Erlanger short rank: www.erlangersqueezeplay.com

Market vane*: www.marketvane.net

Schaeffer`s research: www.schaeffersearch.com

VolumeMarket volume: www.marketvolume.com

Pattern recognition

Investtech: www.investtech.com

Data

Chicago board of trade: www.cbot.com

Chicago board options exchange: www.cboe.com

Commodity futures trading commission: www.cftc.gov

Chicago mercantile exchange: www.cme.com

Commitment of traders: www.commitmentoftrders.com

Commodity research bureau: www.crbtrader.com

End-of-day data(free downloads): www.eoddata.com

Opec: www.opec.org

Statistics Canada: www.statcan.ca

World golg council: www.gold.org

Charting

Barchart: www.barchart.com

Bigcharts: www.bigcharts.com

Dorsey wright and associates: www.dorseywright.com

Incredible charts: www.incrediblecharts.com/site_map.htm

E-signal: www.esognl.com

FX-trek: www.fxtrek.com

Litwick candlestick analysis: www.litwick.com/glossary

Stockcharts: www.stockcharts.com

Stockpoint: www.stockpoint.com

Elliott wave

Aerodynamic investments: www.aeroinvest.com

Elliott wave international: www.elliottwave.com

Bonds

Bond market association: www.bondmarket.com

Bond talk: www.bondtalk.com

Technical analysis associations

IFIA: www.ifta.org

MTA: www.mata.org

Education

Candlecharts: www.candlecharts.com

Candlestick: www.candlestickshop.com/glossary

Day trading university: www.daytradinguniversity.com

Decision point: www.decisionpoint.com/tacourse/tacoursemenu.html

Dorsey wright and associates: www.dorseywright.com

Alexander elder*: www.elder.com

E-analytics: www.e-analytics.com

Equis: www.equis.com/free/taaz

Litwick: www.litwick.com/glossary

Market mavens: www.marketmavens.com

Marketwise trading school*: www.marketwise.com

Momentum trading: www.mtrader.com

Murphy morris*: www.murphymorris.com

Pristine: www.stockcharts.com/

Stock charts: www.stockcharts.com/eduction

Stock & commodities magazine: www.traders.com

Traders book press: www.traderspress.com

Trading tutor ( larry pesavento ): www.tradingtutour.com

Gann and cycle analysis

Aerodynamic investment**: www.aeroinvest.com

Calendar research: www.aeroinvest.com

Stock market geometry: www.cycle-trader.comIndicators

Bollinger bands*: www.bollingerbands.com

Fibonacci indicators: www.fibonaccitrader.com

SentimentConsensus: www.consensus-inc.com

Erlanger short rank: www.erlangersqueezeplay.com

Market vane*: www.marketvane.net

Schaeffer`s research: www.schaeffersearch.com

VolumeMarket volume: www.marketvolume.com

Pattern recognition

Investtech: www.investtech.com

Data

Chicago board of trade: www.cbot.com

Chicago board options exchange: www.cboe.com

Commodity futures trading commission: www.cftc.gov

Chicago mercantile exchange: www.cme.com

Commitment of traders: www.commitmentoftrders.com

Commodity research bureau: www.crbtrader.com

End-of-day data(free downloads): www.eoddata.com

Opec: www.opec.org

Statistics Canada: www.statcan.ca

World golg council: www.gold.org

Charting

Barchart: www.barchart.com

Bigcharts: www.bigcharts.com

Dorsey wright and associates: www.dorseywright.com

Incredible charts: www.incrediblecharts.com/site_map.htm

E-signal: www.esognl.com

FX-trek: www.fxtrek.com

Litwick candlestick analysis: www.litwick.com/glossary

Stockcharts: www.stockcharts.com

Stockpoint: www.stockpoint.com

Elliott wave

Aerodynamic investments: www.aeroinvest.com

Elliott wave international: www.elliottwave.com

Bonds

Bond market association: www.bondmarket.com

Bond talk: www.bondtalk.com

Thursday, February 21, 2008

Thursday 2-21-2008

9:30 AM

The pre-market was up huge. The market is in the break out phase of triangle formation. Everybody was nervous due to its magnitude of 5% swing. Due to my amaturity, my positions are all on the short side. So I have to wait and see, or just sit dead. Anyway, all I can do is hope.

The pre-market was up huge. The market is in the break out phase of triangle formation. Everybody was nervous due to its magnitude of 5% swing. Due to my amaturity, my positions are all on the short side. So I have to wait and see, or just sit dead. Anyway, all I can do is hope.

Wednesday, February 20, 2008

Wednesday 2-20-2008

10:30 AM

The market is in a down direction. The CPI number is not good. Meanwhile, the housing starts numbers are not bad. But overall, the CPI number over weighs. So the market is going down. The TA supports this movement.

The sentiment is that many bulls don't believe it as the major trend line hasn't been broken yet. We should see.

The market is in a down direction. The CPI number is not good. Meanwhile, the housing starts numbers are not bad. But overall, the CPI number over weighs. So the market is going down. The TA supports this movement.

The sentiment is that many bulls don't believe it as the major trend line hasn't been broken yet. We should see.

Tuesday, February 19, 2008

Tuesday 2-19-2008

9:30 AM

The future market shows a higher opening. All indices are up more than 1.25%. But they are still in the triangle zone. The up line is 1368 for the S&P. If it breaks this line, I expect the market will do A-B-C. Otherwise, that market will trade within the triangle.

12:00 PM

So far, the market is still trapped in that triangle. The buying power is very weak. Shyuan on DQ and Hutong9.com is a very good researcher. He concludes that in major events, hedge funds preset positions. If those positions can't make profit, the next day, they will try to make the market move so that these positions can escape. He observed the events on Dec 11 (Fed rate cut) & 12, and Jan 31 & Fed 1.

Now, I believe it happened again. Last Friday was OE day, and those hedge funds hoping for a huge up day. So they preseat long positions. Unfortunately, there was no short-covering and lack of buying. Those positions are lossing money. So this morning, they moved the market in order to escape. Based on this, I expect the market will make big movement (down) soon.

The future market shows a higher opening. All indices are up more than 1.25%. But they are still in the triangle zone. The up line is 1368 for the S&P. If it breaks this line, I expect the market will do A-B-C. Otherwise, that market will trade within the triangle.

12:00 PM

So far, the market is still trapped in that triangle. The buying power is very weak. Shyuan on DQ and Hutong9.com is a very good researcher. He concludes that in major events, hedge funds preset positions. If those positions can't make profit, the next day, they will try to make the market move so that these positions can escape. He observed the events on Dec 11 (Fed rate cut) & 12, and Jan 31 & Fed 1.

Now, I believe it happened again. Last Friday was OE day, and those hedge funds hoping for a huge up day. So they preseat long positions. Unfortunately, there was no short-covering and lack of buying. Those positions are lossing money. So this morning, they moved the market in order to escape. Based on this, I expect the market will make big movement (down) soon.

Friday, February 15, 2008

Friday 2-15-2008

7:30 AM

The market had a decent sell off yesterday, from open to close. The bond insurers were down graded, which started a couple of weeks ago. This sell off took back all the gains on Wednesday. The volume is heavier than relative low volumes while the market was moving up. Today is the OE day, so I expect the market either stall or downwards as I saw the put/call open interests is high, I still think since the puts are traded by the MMs, they want to make money.

The market had a decent sell off yesterday, from open to close. The bond insurers were down graded, which started a couple of weeks ago. This sell off took back all the gains on Wednesday. The volume is heavier than relative low volumes while the market was moving up. Today is the OE day, so I expect the market either stall or downwards as I saw the put/call open interests is high, I still think since the puts are traded by the MMs, they want to make money.

Wednesday, February 13, 2008

Wednesday 2-13-2008

11:30 AM

The Jan retails sales was okay up .3% as expect, which pushed all indices higher. Dow was up more than 100 pts, now it is around 70s. The overall sentiment is still bearish. I am holding all short positions.

The Jan retails sales was okay up .3% as expect, which pushed all indices higher. Dow was up more than 100 pts, now it is around 70s. The overall sentiment is still bearish. I am holding all short positions.

Tuesday, February 12, 2008

Tuesday 2-12-2008

9:45 AM

Buffet started investing into bond insurers. The market gapped up. Again, nothing has been changed so far. The short term is up, and mid term is down. SO I am still on one side play.

Buffet started investing into bond insurers. The market gapped up. Again, nothing has been changed so far. The short term is up, and mid term is down. SO I am still on one side play.

Monday, February 11, 2008

Monday 2-11-2008

2:30 PM

The market opened low, went low, and now it goes up, and making a horizontal S. Since this market is heading lower, I have to play on one side. I have closed all the long positions, and heavily shorted the market right now.

The market opened low, went low, and now it goes up, and making a horizontal S. Since this market is heading lower, I have to play on one side. I have closed all the long positions, and heavily shorted the market right now.

Sunday, February 10, 2008

Weekend 2-10-2008

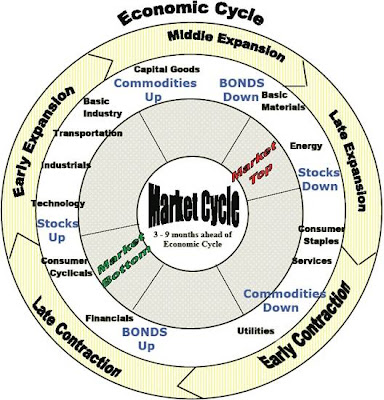

There are 5 stage of economy cycle, they are contraction: 1. early; 2. late, expansion: 1. early; 2. middle; 3. late. We are at early stage of contraction. The market has been down since Oct 2007 for 4 months. It matches the chart from Sep 2000 to Jan 2001 on S&P. This also marks the 1945-1996 statistics data on average down percentage. So it might start a pause and watch phase. Also the average down trend based on the history data is 7 months.

Therefore, I will have to pause and watch too. In the next 3 months, the market can go either ways for the short term. But the mid/long term trend is still down. I expect there will be another leg down. So the bias is to play the down trend for new low. After that, there might be a mid term rally, followed by a mid/long term down turn to retest the new low during or after summer time. Then we will have a huge leg up to close near flat for the whole year.

Therefore, I will have to pause and watch too. In the next 3 months, the market can go either ways for the short term. But the mid/long term trend is still down. I expect there will be another leg down. So the bias is to play the down trend for new low. After that, there might be a mid term rally, followed by a mid/long term down turn to retest the new low during or after summer time. Then we will have a huge leg up to close near flat for the whole year.

Friday, February 8, 2008

Friday 2-9-2008

5:30 PM

The market was up and down, but moving no where. So it is clear that it is consolidation. The trend is very clear now, that the market wants to go down. NO long positions only for a little bit of hedge. Short whenever it goes higher.

The market was up and down, but moving no where. So it is clear that it is consolidation. The trend is very clear now, that the market wants to go down. NO long positions only for a little bit of hedge. Short whenever it goes higher.

Thursday, February 7, 2008

Wednesday 2-6-2008

9:20 Am

Yesterday was a big reverse day (continuation day -down trend). I have sold all the shorts, and loaded 1/3 positions of shorts, which was a very bad move.

I do have some problems with these type of days. I think the easy way to avoid is that once positions are cleared, don't jump in too quick. Wait out side and watch for a while see if there is any clear picture. That is to wait for the whole day till next day to see the direction.

This morning, the future is way down. Let's see how it plays out. S&P 1315 (SPY 131.18) is the 61.8% retrace from current up leg - A leg. If it breaks, the Jan low will be re-tested. I will load 100 shares of SSO at SPY $131.18 and QLD at QQQQ $41.60.

Yesterday was a big reverse day (continuation day -down trend). I have sold all the shorts, and loaded 1/3 positions of shorts, which was a very bad move.

I do have some problems with these type of days. I think the easy way to avoid is that once positions are cleared, don't jump in too quick. Wait out side and watch for a while see if there is any clear picture. That is to wait for the whole day till next day to see the direction.

This morning, the future is way down. Let's see how it plays out. S&P 1315 (SPY 131.18) is the 61.8% retrace from current up leg - A leg. If it breaks, the Jan low will be re-tested. I will load 100 shares of SSO at SPY $131.18 and QLD at QQQQ $41.60.

Tuesday, February 5, 2008

Tuesday 2-5-2008

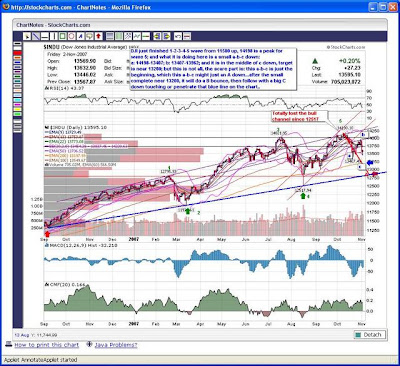

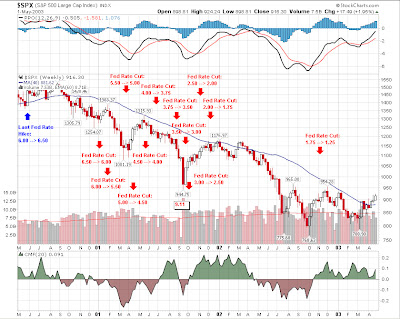

2 chart of S&P during 2000-2001 and 2007-2008. Each one has the fed rate cut.

2 chart of S&P during 2000-2001 and 2007-2008. Each one has the fed rate cut.9:00 AM

Yesterday, the market went down more than 100 pts. It is a sizable down. Today, the future is down a lot. The current correction wave of A-B-C is starting at B wave down. The current A wave up in S&P is 1400-1370 = 130 points. The B correction is looking at 38.2% of 130 pts, which is, S&P at 1350 level.

Yesterday, the market went down more than 100 pts. It is a sizable down. Today, the future is down a lot. The current correction wave of A-B-C is starting at B wave down. The current A wave up in S&P is 1400-1370 = 130 points. The B correction is looking at 38.2% of 130 pts, which is, S&P at 1350 level.

12:45 PM

The S&P 1350 level is broken. Now, I am looking at S&P 1320 level. I believe that since the news - Service segment in recession, is so huge that the 1st lvl of support should be broken. Plus the today's volumes are above average in the wake of yesterday's 2/3 of normal volumes. The sell is intensifying.

Monday, February 4, 2008

Monday 2-4-2008

11:30 AM

The last 2 days were volatile, both went up in a big size. In both of the days, the market went down over 100 pts in the morning, and came back with more than 100 points gain in the afternoon. Basically, I marked them distribution days.

This morning, the pre-market was flat. Now it is down on .5% average. I guess it either starts the A-B-C wave B leg or rolling down. We should see it clearly. If the market close flat, I am gonna lean towards the rollover formation. If the market close sizable down, I will think this is the B leg down. If the market goes up. I will add short position.

The last 2 days were volatile, both went up in a big size. In both of the days, the market went down over 100 pts in the morning, and came back with more than 100 points gain in the afternoon. Basically, I marked them distribution days.

This morning, the pre-market was flat. Now it is down on .5% average. I guess it either starts the A-B-C wave B leg or rolling down. We should see it clearly. If the market close flat, I am gonna lean towards the rollover formation. If the market close sizable down, I will think this is the B leg down. If the market goes up. I will add short position.

Subscribe to:

Comments (Atom)