Saturday, August 22, 2009

Sunday, March 15, 2009

Saturday, March 7, 2009

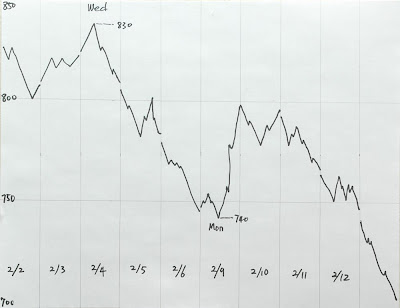

Thursday, March 5, 2009

Status Quote and Future

The market has been down around 55% from the top. If the history can be any reference, it is in the time of April 24-25, 1931. If you look at the chart from April 1931 to the bottom July 1932. This is the top of the market in next 2 years. It didn't reach the same level until Nov, 1937, which is about 5.5 years. So I think from now on, no longs. And short when ever the market goes higher.

Monday, March 2, 2009

Tuesday, February 17, 2009

Here’s another brutal look at where P/E rations might end up going before this is all over, via Bob Bronson:

I am very skeptical of earnings forecasts, because they have been so terrible for most of my adult life. The conspiracy of optimists always seems to overestimate future earnings.

Trailing earnings are real data, not opinion of guesswork. They provide a factual basis for valuation, and not a wishful or theoretical version. Those who were claiming that there is no recession have now taken to saying we are at the worst levels of the recession. Often, we see forward earnings estimates at the heart of this faulty analysis.

Forward earnings guesswork are why the analyst community missed the credit crisis, why they could expected a 20% Q3, and 50% Q4 earnings rebound. Hence, the forward earnings consensus led to calls for 1350 and even 1550 on the S&P . . . Its now about half of that.

Rather than rely on Wall Street Analysts who are chock full of the conflicts, and seem structurally incapable of catching major economic turns, let’s revisit a long term look at P/E ratios, via historical cycles.

Sunday, February 1, 2009

Subscribe to:

Comments (Atom)